| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| JKSE | 0.82% | 6,716.46 |

| JKLQ45 | 0.22% | 947.73 |

| JKIDX30 | 0.12% | 491.86 |

| EIDO | -0.56% | 22.92 |

| FTSE Indonesia | 0.02% | 3,647.95 |

| USD/IDR | 0.79% | 15,159 |

Provided by AIT, last update 7 Juli 2023

Market Review

Pasar saham Indonesia akan mengawali pekan kedua Juli dengan modal positif setelah sepanjang perdagangan pekan lalu mampu menguat hampir 1%. Sementara nilai rupiah harus berakhir di zona merah pada perdagangan pekan lalu. Investor global mencerna laporan pekerjaan Amerika yang akan mempengaruhi keputusan The Fed terkait kebijakan suku bunga.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 0.30% | 1,925.30 |

| Crude Oil WTI | 4.35% | 73.71 |

| Palm Oil c3 F | 1.19% | 3,834 |

| Natural Gas | -8.40% | 2.56 |

| Newcastle Coal | 9.33% | 140.00 |

| Nickel | 1.50% | 20,824 |

| Tin | 5.81% | 28,342 |

| Copper | 0.64% | 8,369 |

| Aluminium | -0.35% | 2,144 |

| US Soybeans | -8.51% | 1,319.25 |

Provided by AIT, last update 7 Juli 2023

Economic Data

Dari dalam negeri, rilis data inflasi periode Juni 2023 menjadi sentimen utama. Pada Senin (3/7), Badan Pusat Statistik (BPS) mengumumkan inflasi RI pada Juni 2023 sebesar 0,14% secara bulanan (month-to-month/mtm) dan 3,52% secara tahunan (year-on-year/yoy). Inflasi Mei tercatat 0,09% (mtm) dan 3,0% (yoy). Inflasi inti tercatat sebesar 2,66%. Hal ini menjadi potensi Bank Indonesia (BI) untuk menurunkan suku bunganya lebih awal, menurut beberapa ekonom. Inflasi di Asia Tenggara berangsur-angsur mereda sejak mencapai puncaknya September lalu sebesar 6%.

Rupiah yang mencetak kinerja terburuk di Asia pada pekan lalu, salah satu penyebabnya adalah penurunan cadangan devisa yang diumumkan oleh Bank Indonesia (BI) pada Jumat kemarin.BI mencatat posisi cadangan devisa Indonesia pada akhir Juni 2023 tetap tinggi sebesar US$ 137,5 miliar, meskipun menurun sebesar US$ 1,8 miliar dari posisi pada akhir Mei 2023 sebesar US$ 139,3 miliar. BI mengungkapkan penurunan posisi cadangan devisa tersebut antara lain dipengaruhi oleh pembayaran utang luar negeri pemerintah , BI memandang cadangan devisa akan tetap memadai, didukung oleh stabilitas dan prospek ekonomi yang terjaga, seiring dengan respons bauran kebijakan yang ditempuh BI dalam menjaga stabilitas makroekonomi dan sistem keuangan untuk mendukung pertumbuhan ekonomi yang berkelanjutan.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | -1.95% | 33,734.88 |

| S&P 500 | -1.16% | 4,398.95 |

| FTSE 100 | -3.65% | 7,256.94 |

| DAX | -3.37% | 15,603.40 |

| Nikkei 225 | -2.41% | 32,388.42 |

| Hang Seng | -2.91% | 18,365.70 |

| Shanghai | -0.17% | 3,196.61 |

| KOSPI | -1.47% | 2,526.71 |

Provided by AIT, last update 7 Juli 2023

Regional Info

Pada pasar global, aksi saling balas pengetatan ekspor dan transfer teknologi yang berkaitan dengan industri semikonduktor antara China dan AS yang memanas turut mewarnai perdagangan minggu lalu, China menerapkan pembatasan ekspor pada dua mineral yang menurut AS sangat penting untuk produksi semikonduktor, sistem rudal, dan sel surya.

Di tengah tegangnya tensi antara kedua negara raksa tersebut, Menteri Keuangan AS Janet Yellen tiba di Beijing, China, pada Kamis sore waktu setempat (6/7), dengan tujuan menemukan pijakan ekonomi bersama dan membuka saluran komunikasi bilateral di tengah hubungan yang semakin bergejolak antara dua ekonomi terbesar dunia tersebut.

Data pekerjaan yang kuat membuat investor khawatir jika bank sentral AS (Federal Reserve/The Fed) akan kembali mengetatkan kebijakan moneter ke depan. Angka pekerjaan sektor swasta meningkat sebesar 497.000 pada Juni, menurut data dari perusahaan penggajian ADP. Angka ini menjadi kenaikan bulanan tertinggi sejak Juli 2022. Sedangkan pada Jumat, data tenaga kerja non-pertanian (non-farm payroll/NFP) dan data tingkat pengangguran dirilis, angkanya turun menjadi 209.000 pada Juni 2023, dari sebelumnya sebesar 306.000 pada Mei lalu. Angka itu juga lebih rendah dari prediksi pasar sebesar 250.000.

Data inflasi harga konsumen (consumer price index/CPI) akan dirilis pada Rabu (12/7/23) dan inflasi harga produsen (producer price index/PPI) pada Kamis (13/7/23). Konsensus ekonom menyebut, CPI tahunan AS per Juni akan turun menjadi 3,1% dari bulan sebelumnya 4%, dan menandai laju tahunan paling lambat sejak Maret 2021.

Insight 2023 3rd Quarter, 2nd week

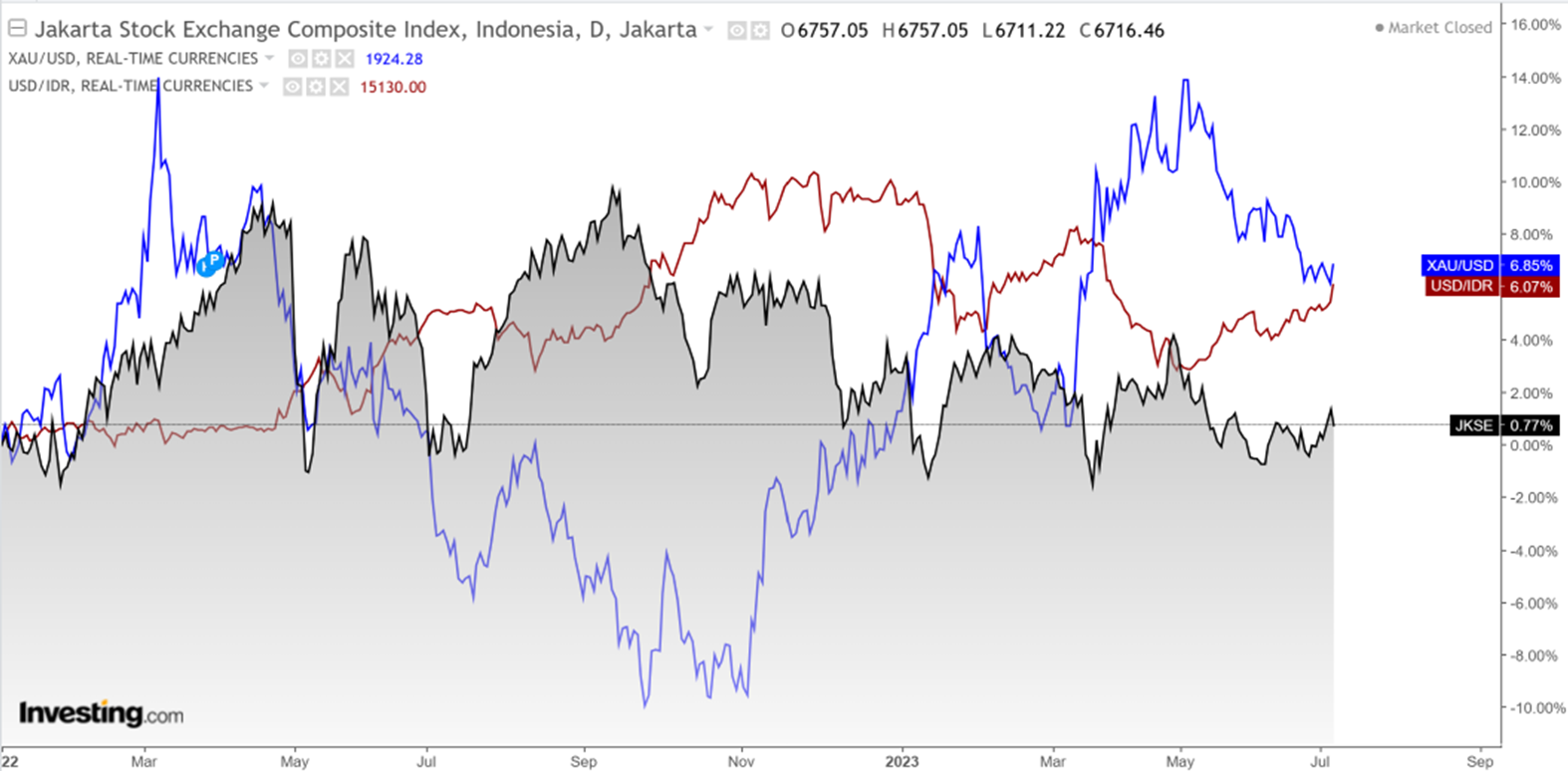

IHSG, walaupun pekan lalu terendah di 6662.35, tertinggi di 6766.27 dan ditutup melemah ke 6716.46, overall masih +0.82% lebih tinggi dari penutupan pekan sebelumnya. Walau sudah berada di titik aman, pekan ini IHSG cenderung terkoreksi dalam rentang 6651.73 – 6817.61. Jika tertarik dengan saham ataupun reksadana Saham, ini momen terbaik sebelum melanjutkan uptrend.

Rupiah, pekan lalu ditutup melemah 0.79% terhadap dollar amerika, ke posisi 15130. Pekan ini rupiah masih akan melemah menuju 15345, support 14890—15030.

Emas, data ekonomi pekan depan akan menggerakan emas dunia dalam range lebar, antara 1892—1954 per troyounce. Dalam rupiah, emas per gram akan berkisar 1.018 Juta rupiah.

Reksa dana, kinerja 1 bulan terakhir, RD Saham juaranya, diikuti oleh Campuran dan Pendapatan Tetap.

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM (M) |

| Batavia Dana Dinamis | 9324.93 | -0.40% | 0.61% | 3.79% | 5.00% | 8.97% | 31.36% | 832.49% | 3-Jun-2002 | 355.62 |

| Principal Balanced Strategic Plus | 1271.19 | -0.26% | 1.42% | 2.96% | 5.54% | 9.16% | 25.55% | 27.12% | 28-May-2012 | 7.81 |

| Sam Mutiara Nusantara Nusa Campuran | 1860.0429 | -0.88% | 1.13% | 1.68% | 8.54% | 7.57% | 57.27% | 86.00% | 21-Dec-2017 | 27.50 |

| Sequis Balance Ultima | 1221.4371 | -0.30% | 0.98% | 3.52% | 4.62% | 8.44% | 21.18% | 22.14% | 8-Sep-2016 | 134.83 |

| Setiabudi Dana Campuran | 1340.325 | -0.26% | 2.81% | 3.30% | 5.45% | 9.59% | 57.88% | 34.03% | 25-Sep-2017 | 58.13 |

| Syailendra Balanced Opportunity Fund | 3124.22 | -0.20% | 3.16% | 2.40% | 2.02% | -4.20% | 43.21% | 212.42% | 22-Apr-2008 | 149.18 |

| Trim Kombinasi 2 | 2619.63 | -0.36% | 1.71% | 5.77% | 5.82% | 7.89% | 34.14% | 161.96% | 10-Nov-2006 | 23.88 |

| Trim Syariah Berimbang | 3092.02 | -0.24% | 1.65% | 4.14% | 5.81% | 5.95% | 25.62% | 209.20% | 27-Dec-2006 | 19.84 |

Provided by AIT, last update 7 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM (M) |

| Cipta Dana Cash | 1581.06 | 0.00% | 0.19% | 1.03% | 2.22% | 4.28% | 13.11% | 58.11% | 8-Jun-2015 | 200.12 |

| Danakita Stabil Pasar Uang | 1501.42 | 0.01% | 0.37% | 1.12% | 2.25% | 3.90% | 13.15% | 50.14% | 10-Sep-2015 | 179.14 |

| Hpam Ultima Money Market | 1499.0815 | 0.01% | 0.35% | 1.12% | 2.38% | 4.15% | 14.77% | 49.91% | 10-Jun-2015 | 738.62 |

| Insight Retail Cash Fund | 1465.7524 | 0.01% | 0.43% | 1.37% | 2.41% | 3.99% | 13.60% | 46.58% | 13-Apr-2018 | 2.86 |

| Setiabudi Dana Pasar Uang | 1392.8656 | 0.01% | 0.38% | 1.16% | 2.26% | 3.95% | 13.17% | 39.29% | 23-Dec-2016 | 610.50 |

| Syailendra Dana Kas | 1571.6796 | 0.01% | 0.34% | 1.05% | 2.11% | 4.06% | 13.30% | 57.17% | 12-Jun-2015 | 4,123.19 |

| Trim Kas 2 Kelas A | 1764.8648 | 0.01% | 0.35% | 1.06% | 2.12% | 3.91% | 12.73% | 76.49% | 8-Apr-2008 | 3,645.30 |

| Trimegah Kas Syariah | 1324.9608 | 0.01% | 0.36% | 1.07% | 2.14% | 3.92% | 11.41% | 32.50% | 30-Dec-2016 | 314.13 |

Provided by AIT, last update 7 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM (M) |

| Bni-Am Dana Pendapatan Tetap Nirwasita | 1610.8 | -0.25% | 0.84% | 3.47% | 6.44% | 10.62% | 23.51% | 61.08% | 16-Jun-2016 | 54.57 |

| Bni-Am Dana Pendapatan Tetap Syariah Ardhani | 1576.11 | -0.19% | 0.97% | 4.10% | 6.07% | 7.64% | 22.58% | 57.61% | 16-Aug-2016 | 247.33 |

| Bni-Am Short Duration Bonds Index Kelas R1 | 1054.7 | -0.23% | 0.07% | 3.39% | 4.53% | - | - | 5.47% | 1-Sep-2022 | 5.14 |

| Danakita Obligasi Negara | 1067.66 | -0.19% | 0.11% | 2.17% | 3.62% | 6.13% | - | 6.77% | 26-Mar-2021 | 54.43 |

| Eastspring Idr Fixed Income Fund Kelas A | 1684.06 | -0.29% | 0.60% | 3.06% | 5.18% | 8.99% | 20.34% | 68.41% | 16-Mar-2015 | 101.70 |

| Eastspring Investments Idr High Grade Kelas A | 1636.29 | -0.34% | 0.60% | 2.72% | 5.11% | 9.06% | 16.98% | 63.63% | 9-Jan-2013 | 18.39 |

| Hpam Government Bond | 1529.8617 | -0.25% | 0.51% | 3.06% | 5.57% | 9.09% | 19.13% | 52.99% | 18-May-2016 | 12.91 |

| Insight Haji Syariah | 4582.7235 | 0.02% | 0.57% | 1.81% | 3.76% | 7.23% | 24.90% | 358.27% | 13-Jan-2005 | 1,628.91 |

| Principal Income Fund Syariah | 1105.54 | -0.19% | 1.65% | 5.26% | 5.82% | 6.99% | - | 10.55% | 21-Oct-2020 | 3.23 |

| Sam Sukuk Syariah Sejahtera | 2476.553 | -0.17% | 0.93% | 1.83% | 4.50% | 6.30% | 20.64% | 147.66% | 29-Oct-1997 | 51.44 |

| Trimegah Fixed Income Plan | 1133.5646 | 0.02% | 0.52% | 1.58% | 3.40% | 6.27% | 21.28% | 13.36% | 23-May-2019 | 3,462.95 |

| Trimegah Terproteksi Futura 27 | 1060.5503 | -0.08% | 0.48% | 0.78% | 8.61% | - | - | 6.06% | 8-Dec-2022 | 41.03 |

Provided by AIT, last update 7 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM (M) |

| Bahana Primavera 99 Kelas G | 1304.86 | -0.85% | 1.29% | 1.15% | 2.97% | 9.40% | 25.85% | 30.49% | 5-Sep-2014 | 1,932.72 |

| Batavia Dana Saham | 63650.3 | -0.63% | 0.68% | 4.36% | 4.18% | 9.21% | 29.31% | 6265.03% | 16-Dec-1996 | 4,504.83 |

| Batavia Dana Saham Optimal | 3254.28 | -0.53% | 1.44% | 5.31% | 5.88% | 9.33% | 40.42% | 225.43% | 19-Oct-2006 | 640.96 |

| Batavia Disruptive Equity | 1041.53 | -0.75% | 1.15% | 5.45% | 7.06% | 10.20% | - | 4.15% | 15-Dec-2021 | 39.19 |

| Bni-Am Indeks Idx Growth30 Kelas R1 | 1135.33 | -1.18% | 0.66% | 0.54% | 2.83% | 13.58% | - | 13.53% | 27-Jan-2022 | 0.78 |

| Cipta Rencana Cerdas | 18347.63 | -0.55% | 2.34% | 6.39% | 6.91% | 15.83% | 48.48% | 1734.76% | 9-Jul-1999 | 104.86 |

| Cipta Saham Unggulan | 3110.62 | -0.88% | 6.76% | 11.28% | 12.39% | 20.76% | 90.02% | 211.06% | 4-Dec-2018 | 50.49 |

| Cipta Saham Unggulan Syariah | 2632.68 | -0.86% | 7.94% | 12.91% | 12.79% | 16.61% | 79.31% | 163.27% | 5-Sep-2018 | 19.94 |

| Danakita Saham Prioritas | 1168.67 | -0.62% | 0.75% | 3.11% | 6.26% | 14.61% | 35.61% | 16.87% | 17-Oct-2018 | 11.63 |

| Eastspring Investments Alpha Navigator Kelas A | 1547.05 | -0.58% | 0.17% | 4.09% | 4.51% | 9.39% | 36.58% | 54.71% | 29-Aug-2012 | 137.22 |

| Sam Indonesian Equity Fund | 2155.48 | -0.36% | 2.37% | 7.06% | 4.83% | 13.70% | 43.36% | 115.55% | 18-Oct-2011 | 964.53 |

| Syailendra Equity Opportunity Fund | 4066.82 | -0.78% | 1.52% | 6.26% | 6.12% | 9.25% | 32.03% | 306.68% | 7-Jun-2007 | 356.62 |

| Syailendra Msci Indonesia Value Index Fund Kelas A | 1167.39 | -0.63% | 0.60% | 6.06% | 11.32% | 19.18% | 47.24% | 16.74% | 8-Jun-2018 | 685.08 |

| Trim Kapital | 12057.9 | -0.54% | 1.16% | 7.18% | 10.15% | 13.66% | 52.67% | 1105.79% | 19-Mar-1997 | 266.98 |

| Trim Kapital Plus | 4291.85 | -0.53% | 1.38% | 7.88% | 10.38% | 13.39% | 58.71% | 329.19% | 18-Apr-2008 | 166.56 |

Provided by AIT, last update 7 Juli 2023

Event Calendar

| Monday, 10 July 2023 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Current Account MAY | ¥1895.1B | ¥1884.5B | ¥1851B |

| 8:30 AM | CN | Inflation Rate YoY JUN | 0.20% | 0.20% | 0.10% |

| 8:30 AM | CN | Inflation Rate MoM JUN | -0.20% | 0.00% | -0.10% |

| 8:30 AM | CN | PPI YoY JUN | -4.60% | -5.00% | -4.90% |

| 9:00 PM | US | Fed Barr Speech | |||

| 10:00 PM | US | Fed Daly Speech | |||

| 10:00 PM | US | Fed Mester Speech | |||

| 11:00 PM | US | Fed Bostic Speech | |||

| Tuesday, 11 July 2023 | Previous | Consensus | Forecast | ||

| 2:00 AM | GB | BoE Gov Bailey Speech | |||

| 6:01 AM | GB | BRC Retail Sales Monitor YoY JUN | 3.70% | 3.70% | |

| 1:00 PM | DE | Inflation Rate YoY Final JUN | 6.10% | 6.40% | 6.40% |

| 1:00 PM | DE | Inflation Rate MoM Final JUN | -0.10% | 0.30% | 0.30% |

| 1:00 PM | GB | Unemployment Rate MAY | 3.80% | 3.80% | 3.90% |

| 1:00 PM | GB | Average Earnings incl. Bonus (3Mo/Yr) MAY | 6.50% | 6.80% | 6.70% |

| 1:00 PM | GB | Employment Change APR | 250K | 158K | 151K |

| 4:00 PM | DE | ZEW Economic Sentiment Index JUL | -8.5 | -10 | -13 |

| 8:00 PM | US | Fed Bullard Speech | |||

| 9:00 PM | US | IBD/TIPP Economic Optimism JUL | 41.7 | 45.3 | 43 |

| CN | New Yuan Loans JUN | CNY 1360 B | CNY 2337 B | CNY 2250 B | |

| Wednesday, 12 July 2023 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change JUL/07 | -4.382M | ||

| 6:50 AM | JP | Machinery Orders MoM MAY | 5.50% | 1.00% | 1.10% |

| 6:50 AM | JP | Machinery Orders YoY MAY | -5.90% | -0.20% | -0.60% |

| 1:00 PM | GB | Financial Stability Report | |||

| 4:30 PM | DE | 10-Year Bund Auction | 2.43% | ||

| 6:00 PM | US | MBA 30-Year Mortgage Rate JUL/07 | 6.85% | ||

| 7:30 PM | US | Inflation Rate YoY JUN | 4.00% | 3.10% | 3.20% |

| 7:30 PM | US | Core Inflation Rate YoY JUN | 5.30% | 5.00% | 5.00% |

| 7:30 PM | US | Core Inflation Rate MoM JUN | 0.40% | 0.30% | 0.30% |

| 7:30 PM | US | Inflation Rate MoM JUN | 0.10% | 0.30% | 0.20% |

| 7:30 PM | US | CPI JUN | 304.127 | 305.219 | 305.79 |

| 7:30 PM | US | CPI s.a JUN | 303.294 | 303.7 | 303.9 |

| 8:00 PM | RU | Balance of Trade MAY | RUB7.765B | RUB 8.4B | |

| 8:45 PM | US | Fed Kashkari Speech | |||

| 9:30 PM | US | EIA Crude Oil Stocks Change JUL/07 | -1.508M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change JUL/07 | -2.55M | ||

| 11:00 PM | RU | Inflation Rate MoM JUN | 0.30% | 0.40% | 0.20% |

| 11:00 PM | RU | Inflation Rate YoY JUN | 2.50% | 3.30% | 3.10% |

| Thursday, 13 July 2023 | Previous | Consensus | Forecast | ||

| 12:00 AM | US | Fed Bostic Speech | |||

| 3:00 AM | US | Fed Mester Speech | |||

| 10:00 AM | CN | Balance of Trade JUN | $65.81B | $ 68B | |

| 10:00 AM | CN | Imports YoY JUN | -4.50% | -2.00% | |

| 10:00 AM | CN | Exports YoY JUN | -7.50% | -3.10% | |

| 1:00 PM | GB | GDP MoM MAY | 0.20% | -0.40% | -0.20% |

| 1:00 PM | GB | Manufacturing Production MoM MAY | -0.30% | -0.50% | -0.30% |

| 1:00 PM | GB | GDP 3-Month Avg MAY | 0.10% | -0.10% | 0.00% |

| 1:00 PM | GB | Goods Trade Balance MAY | £-14.996B | £-15.4B | |

| 1:00 PM | GB | Goods Trade Balance Non-EU MAY | £-5.035B | £-4.7B | |

| 1:00 PM | GB | Industrial Production MoM MAY | -0.30% | -0.40% | -0.20% |

| 7:30 PM | US | PPI MoM JUN | -0.30% | 0.20% | 0.10% |

| 7:30 PM | US | Core PPI MoM JUN | 0.20% | 0.20% | 0.10% |

| 7:30 PM | US | Initial Jobless Claims JUL/08 | 248K | 249K | 241.0K |

| Friday, 14 July 2023 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | Monthly Budget Statement JUN | $-240B | $-90B | $ -30B |

| 5:45 AM | US | Fed Waller Speech | |||

| 1:00 PM | DE | Wholesale Prices MoM JUN | -1.10% | -0.60% | |

| 1:00 PM | DE | Wholesale Prices YoY JUN | -2.60% | -3.30% | |

| 7:30 PM | US | Import Prices MoM JUN | -0.60% | -0.10% | -0.20% |

| 7:30 PM | US | Export Prices MoM JUN | -1.90% | -0.30% | -1.20% |

| 9:00 PM | US | Michigan Consumer Sentiment Prel JUL | 64.4 | 65.5 | 64.5 |

| Saturday, 15 July 2023 | Previous | Consensus | Forecast | ||

| 8:30 AM | CN | House Price Index YoY JUN | 0.10% | 0.50% | |

| CN | FDI (YTD) YoY JUN | 0.10% | 0.10% | ||

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya: