| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| JKSE | 2.28% | 6,869.57 |

| JKLQ45 | 1.73% | 964.09 |

| JKIDX30 | 1.82% | 500.82 |

| EIDO | 3.01% | 23.61 |

| FTSE Indonesia | 1.78% | 3,712.92 |

| USD/IDR | -0.84% | 15,003 |

Provided by AIT, last update 14 Juli 2023

Market Review

Pasar keuangan Tanah Air mampu mencatatkan kinerja cemerlang pekan ini dengan penguatan 5 hari beruntun sejak awal pekan. Pendapatan bank dan perusahaan besar yang solid serta laporan inflasi di Amerika yang lebih lemah yang mengangkat sentimen investor.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 1.62% | 1,955.47 |

| Crude Oil WTI | 1.91% | 75.27 |

| Palm Oil c3 F | 1.23% | 3,881 |

| Natural Gas | -1.32% | 2.55 |

| Newcastle Coal | 1.45% | 140.00 |

| Nickel | 3.97% | 21,629 |

| Tin | 0.71% | 28,543 |

| Copper | 3.60% | 8,672 |

| Aluminium | 5.92% | 2,273 |

| US Soybeans | 4.21% | 1,373.25 |

Provided by AIT, last update 14 Juli 2023

Economic Data

Dalam sepekan terakhir, data perdagangan menunjukkan investor asing melakukan aksi beli bersih (net buy) senilai Rp 411,83 miliar di pasar reguler. Dari pasar keuangan lain, Rupiah juga turut mencatatkan kinerja yang cemerlang.

Pekan ini, rupiah mampu menguat 1,17% pada pekan ini. Penguatan tersebut adalah yang paling tajam sejak akhir April tahun ini atau dalam 2,5 bulan terakhir. Dari dalam negeri, kinerja rupiah terbantu oleh data ekonomi yang membaik mulai melandainya inflasi serta dirilisnya aturan mengenai Devisa Hasil Ekspor (DHE). Aturan DHE dibuat lebih ketat termasuk dengan mewajibkan eksportir menaruh DHE minimal 30% dengan jangka waktu paling singkat tiga bulan. Aturan tersebut juga memungkinkan pemerintah mewajibkan konversi jika stabilitas ekonomi tengah goyang. Pengetatan aturan ini diharapkan mampu menambah pasokan dolar AS ke dalam negeri sehingga rupiah bisa semakin kuat ke depan.

Dari dalam negeri pekan ini akan ada rilis data neraca perdagangan untuk periode Juni 2023. Badan Pusat Statistik (BPS) akan merilis data perdagangan internasional Indonesia periode Juni 2023 pada Senin (16/7/2023). Surplus neraca perdagangan diperkirakan melonjak pada Juni 2023. Surplus naik karena lonjakan impor seperti pada Mei diproyeksi tidak akan terulang.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 2.29% | 34,509.03 |

| S&P 500 | 2.42% | 4,505.42 |

| FTSE 100 | 2.45% | 7,434.57 |

| DAX | 3.22% | 16,105.07 |

| Nikkei 225 | 0.01% | 32,391.26 |

| Hang Seng | 5.71% | 19,413.78 |

| Shanghai | 1.29% | 3,237.70 |

| KOSPI | 4.02% | 2,628.30 |

Provided by AIT, last update 14 Juli 2023

Regional Info

Pergerakan Indeks Wall Street diwarnai oleh pendapatan bank dan perusahaan besar yang solid serta laporan inflasi yang lebih lemah yang mengangkat sentimen investor. Hal tersebut meningkatkan harapan Bank sentral AS atau Federal Reserve (Fed) mungkin dapat meredam inflasi tanpa membuat ekonomi jatuh ke dalam resesi. Saham UnitedHealth melonjak 7,2% dan membantu Dow berakhir lebih tinggi. Saham asuransi kesehatan lainnya juga naik, dengan Humana berakhir 2,5% dan Cigna naik 4,7%. Di saat yang sama, JPMorgan Chase naik 0,6% setelah laba kuartal kedua melampaui ekspektasi. Bank didorong oleh suku bunga yang lebih tinggi dan pendapatan bunga yang meningkat.

Pada awal pekan ini rilis data pertumbuhan ekonomi China untuk kuartal II-2023. Perekonomian China naik 4,5% yoy pada kuartal I-2023, meningkat dari pertumbuhan 2,9% di kuartal IV-2022 dan melampaui perkiraan pasar sebesar 4%. Itu adalah laju ekspansi terkuat sejak Kuartal I-2022, di tengah upaya untuk memacu pemulihan pasca pandemi. Namun, badan statistik China menyebutkan dalam sebuah pernyataan bahwa lingkungan global yang kompleks dan permintaan domestik yang tidak mencukupi mengartikan pondasi untuk pemulihan negara belum maksimal. China menetapkan target PDB moderat sekitar 5% untuk tahun 2023. Tahun lalu, ekonomi bertambah 3%, meleset dari target pemerintah di 5,5%.

Insight 2023 3rd Quarter, 3rd week

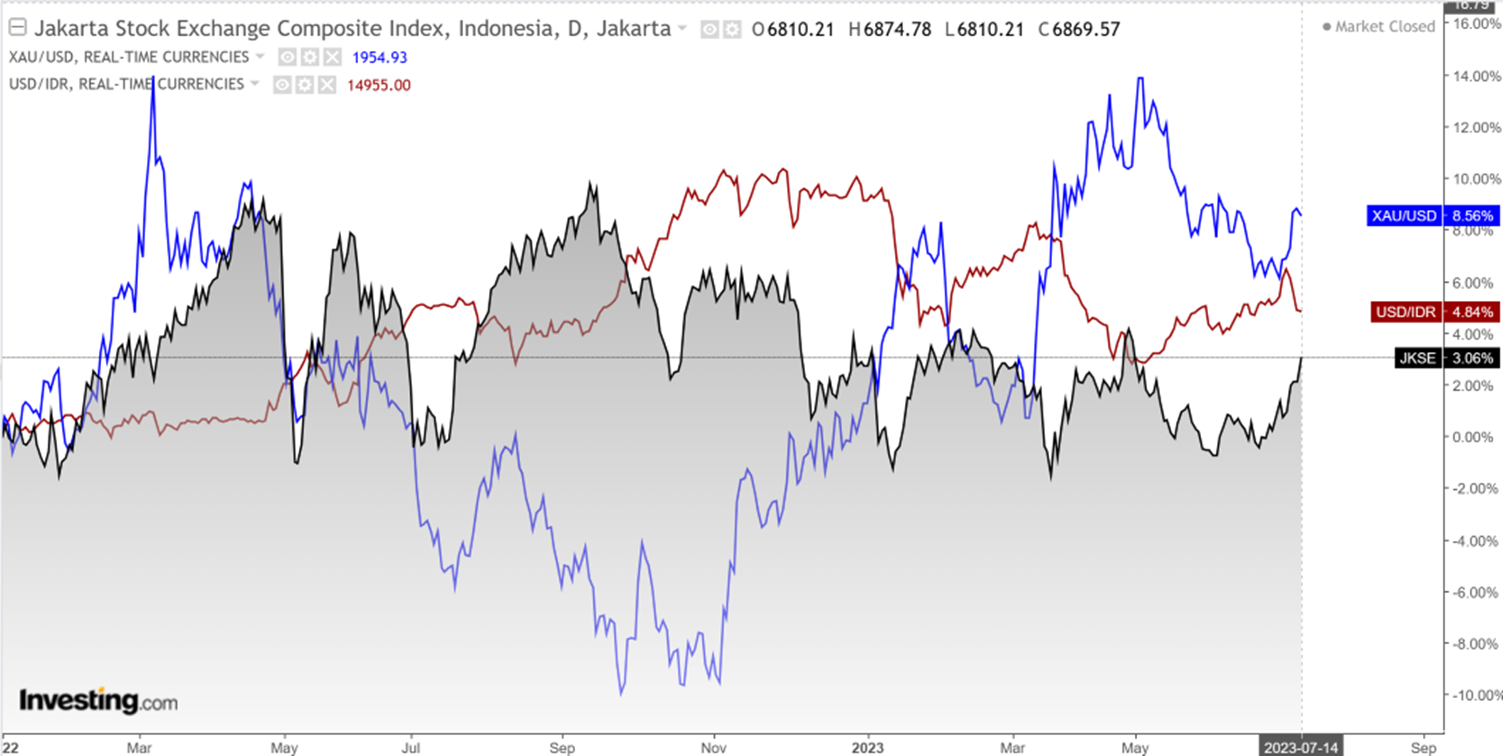

IHSG, sejak awal tahun 2023, IHSG atau Composite Indeks selalu bergerak dalam area 6557 (Support) —6970 (Resistance), quartal 1 dan 2 polanya sama. Apakah kali ini IHSG mampu mendobrak resisten zona tersebut untuk menuju resistance berikutnya yaitu 7222.89 ? Sementara Support IHSG nantinya di sekitar 6718.76.

Rupiah, berdasarkan data Bank Indonesia, pekan lalu Rupiah sempat melemah ke posisi 15267.96, kemudian menguat ke posisi 14903.11. Untuk pekan ini, Rupiah bergerak dalam rentang 14849—15080.

Emas, data ekonomi Amerika yang sesuai konsesus dan membaik, pekan lalu membawa harga emas dunia kembali terbang ke posisi 1955 per t’oz bahkan sempat 1963.73 per t’oz. Artinya harga emas dunia naik lebih dari 50 USD per t’oz dalam sepekan. Sehingga awal semester 2 atau awal Quartal 3 ini, memungkinkan harga emas dunia kembali menuju 1992 per t’oz, dengan Support nantinya di sekitar 1933.15 per t’oz. Dalam kurs rupiah, berkisar 937360—965895 per gram.

Penguatan Rupiah dan potensi IHSG untuk berhasil menembus resisten (6970) yang selama ini tidak pernah mampu ditembus ke atas, memberi kesempatan bagi Reksa Dana Saham untuk bergerak lebih tinggi, terutama yang berbasis indeks atau top 10 stock universe dari indeks Srikehati, MNC36, FTSE Indonesia, MSCI Indonesia.

Selain itu, membaiknya data ekonomi dunia, nilai tukar kurs rupiah, membuat reksa dana berbasis USD juga menarik.

Source : BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM |

| Batavia Dana Dinamis | 9414.71 | 0.53% | 1.13% | 4.38% | 6.01% | 10.61% | 31.28% | 841.47% | 3-Jun-2002 | 367.44M |

| SAM Mutiara Nusantara Nusa Campuran | 1859.08 | 0.50% | 0.49% | 1.11% | 8.49% | 8.60% | 53.17% | 85.91% | 21-Dec-2017 | 28.99M |

| Sequis Balance Ultima | 1231.47 | 0.34% | 1.24% | 3.92% | 5.48% | 9.29% | 20.59% | 23.15% | 8-Sep-2016 | 136.39M |

| Setiabudi Dana Campuran | 1352.49 | 0.38% | 2.73% | 3.57% | 6.40% | 9.83% | 56.24% | 35.25% | 25-Sep-2017 | 59.18M |

| Syailendra Balanced Opportunity Fund | 3114.54 | 0.16% | 1.65% | 2.04% | 1.71% | -4.59% | 40.76% | 211.45% | 22-Apr-2008 | 152.25M |

| TRIM Kombinasi 2 | 2635.94 | 0.79% | 1.95% | 7.64% | 6.48% | 9.36% | 32.54% | 163.59% | 10-Nov-2006 | 23.54M |

| TRIM Syariah Berimbang | 3103.57 | 0.40% | 2.00% | 4.49% | 6.21% | 6.04% | 26.16% | 210.36% | 27-Dec-2006 | 19.84M |

| Trimegah Balanced Absolute Strategy Kelas A | 1705.38 | 0.79% | 1.90% | 7.74% | 7.20% | 6.91% | 51.75% | 70.54% | 28-Dec-2018 | 288.64M |

Provided by AIT, last update 14 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM |

| Cipta Dana Cash | 1583.98 | 0.04% | 0.32% | 1.18% | 2.41% | 4.42% | 13.22% | 58.40% | 8-Jun-2015 | 190.18M |

| Danakita Stabil Pasar Uang | 1502.75 | 0.01% | 0.38% | 1.11% | 2.34% | 3.94% | 13.14% | 50.27% | 10-Sep-2015 | 164.78M |

| HPAM Ultima Money Market | 1500.23 | 0.01% | 0.34% | 1.09% | 2.46% | 4.18% | 14.74% | 50.02% | 10-Jun-2015 | 753.19M |

| Insight Retail Cash Fund | 1466.98 | 0.01% | 0.42% | 1.35% | 2.49% | 3.96% | 13.61% | 46.70% | 13-Apr-2018 | 2.95M |

| Setiabudi Dana Pasar Uang | 1394.09 | 0.01% | 0.38% | 1.15% | 2.35% | 3.98% | 13.14% | 39.41% | 23-Dec-2016 | 619.05M |

| Syailendra Dana Kas | 1573.07 | 0.04% | 0.35% | 1.04% | 2.20% | 4.07% | 13.27% | 57.31% | 12-Jun-2015 | 4.01T |

| TRIM Kas 2 Kelas A | 1766.28 | 0.01% | 0.35% | 1.05% | 2.20% | 3.93% | 12.75% | 76.63% | 8-Apr-2008 | 3.32T |

| Trimegah Kas Syariah | 1326.06 | 0.01% | 0.36% | 1.06% | 2.22% | 3.94% | 11.46% | 32.61% | 30-Dec-2016 | 434.95M |

Provided by AIT, last update 14 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM |

| Bahana Mes Syariah Fund Kelas G | 1491.1 | -0.04% | 0.44% | 3.49% | 4.84% | 7.21% | 18.68% | 49.11% | 11-Nov-2016 | 607.12M |

| BNI-AM Dana Pendapatan Tetap Nirwasita | 1615.43 | -0.06% | 0.30% | 3.61% | 6.75% | 11.01% | 23.28% | 61.54% | 16-Jun-2016 | 68.11M |

| BNI-AM Dana Pendapatan Tetap Syariah Ardhani | 1578.22 | -0.02% | 0.52% | 3.86% | 6.22% | 7.77% | 22.15% | 57.82% | 16-Aug-2016 | 316.02M |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1058 | -0.07% | 0.00% | 2.39% | 4.85% | - | - | 7.63% | 1-Sep-2022 | 5.46M |

| Cipta Bond | 1726.51 | 0.02% | -0.07% | 1.35% | 3.44% | 6.89% | 16.21% | 70.13% | 2-Jan-2019 | 23.84M |

| Danakita Obligasi Negara | 1070.77 | 0.06% | 0.04% | 2.39% | 3.92% | 6.80% | - | 7.08% | 26-Mar-2021 | 54.4M |

| Eastspring IDR Fixed Income Fund Kelas A | 1691.1 | -0.04% | 0.41% | 3.37% | 5.62% | 9.56% | 20.22% | 69.11% | 16-Mar-2015 | 131.92M |

| Eastspring Investments IDR High Grade Kelas A | 1644 | -0.10% | 0.57% | 2.99% | 5.61% | 10.27% | 17.09% | 64.40% | 9-Jan-2013 | 25.72M |

| Eastspring Syariah Fixed Income Amanah Kelas A | 1429.13 | -0.01% | 0.33% | 3.30% | 4.57% | 6.00% | 17.91% | 42.91% | 17-Apr-2017 | 209.79M |

| HPAM Government Bond | 1534.9 | -0.07% | 0.19% | 3.15% | 5.92% | 9.64% | 19.07% | 53.49% | 18-May-2016 | 21.06M |

| Insight Haji Syariah | 4588.79 | 0.02% | 0.57% | 1.78% | 3.89% | 7.24% | 24.89% | 358.88% | 13-Jan-2005 | 1.61T |

| Principal Income Fund Syariah | 1106.13 | -0.06% | 0.80% | 5.02% | 5.87% | 7.47% | - | 10.61% | 21-Oct-2020 | 3.39M |

| Syailendra Fixed Income Fund | 2499.83 | -0.04% | 0.42% | 2.80% | 5.75% | 9.20% | 17.96% | 149.98% | 8-Dec-2011 | 243.11M |

| Trimegah Fixed Income Plan | 1134.89 | 0.02% | 0.52% | 1.56% | 3.52% | 6.24% | 20.89% | 30.91% | 23-May-2019 | 3.84T |

Provided by AIT, last update 14 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM (M) |

| Bahana Primavera 99 Kelas G | 1318.95 | 0.63% | 1.69% | 0.89% | 4.09% | 10.26% | 24.45% | 31.89% | 5-Sep-2014 | 1.93T |

| Bahana Primavera Plus | 13335.96 | 0.47% | 2.40% | -1.74% | -3.77% | -4.02% | 9.53% | 1133.89% | 27-May-1997 | 78.86M |

| Batavia Dana Saham | 64580.18 | 0.89% | 1.48% | 5.06% | 5.70% | 11.53% | 29.43% | 2451.40% | 16-Dec-1996 | 4.17T |

| Batavia Dana Saham Optimal | 3296.31 | 0.95% | 1.85% | 6.16% | 7.25% | 11.32% | 40.59% | 229.63% | 19-Oct-2006 | 661.93M |

| Batavia Disruptive Equity | 1057.25 | 0.83% | 1.42% | 6.33% | 8.68% | 12.55% | - | 5.72% | 15-Dec-2021 | 46.2M |

| BNI-AM Dana Saham Syariah Musahamah | 1172.19 | 0.66% | 2.95% | 5.11% | 1.26% | 5.26% | 12.38% | 17.22% | 12-Nov-2015 | 2.42M |

| BNI-AM Indeks IDX Growth30 Kelas R1 | 1155.89 | 0.72% | 1.80% | 0.24% | 4.69% | 13.08% | - | 15.59% | 27-Jan-2022 | 810.36Jt |

| BNI-AM Indeks IDX30 | 894.2 | 0.82% | 1.65% | 3.19% | 6.99% | 2.97% | 22.00% | -7.88% | 28-Dec-2017 | 1.69T |

| BNI-AM Inspiring Equity Fund | 1036.39 | 0.65% | 1.77% | 3.23% | 3.23% | 8.06% | 19.26% | 6.96% | 7-Apr-2014 | 1.31T |

| Cipta Rencana Cerdas | 18668.47 | 0.52% | 3.29% | 7.14% | 8.77% | 17.83% | 48.33% | 2627.99% | 9-Jul-1999 | 107.3M |

| Cipta Saham Unggulan | 3167.04 | 0.39% | 6.59% | 12.14% | 14.43% | 21.06% | 90.84% | 216.70% | 4-Dec-2018 | 51.63M |

| Cipta Saham Unggulan Syariah | 2678.39 | 0.42% | 7.11% | 13.49% | 14.75% | 16.24% | 81.83% | 167.84% | 5-Sep-2018 | 20.57M |

| Danakita Saham Prioritas | 1183.17 | 0.55% | 1.05% | 3.07% | 7.58% | 15.91% | 35.12% | 18.32% | 17-Oct-2018 | 11.27M |

| Eastspring IDX ESG Leaders Plus Kelas A | 984.13 | 1.11% | 0.35% | 3.56% | 4.33% | 4.91% | - | -1.59% | 12-Jan-2022 | 21.17M |

| Eastspring Investments Alpha Navigator Kelas A | 1566.26 | 0.44% | 1.11% | 4.06% | 5.81% | 10.78% | 36.09% | 56.63% | 29-Aug-2012 | 127.36M |

| Eastspring Investments Value Discovery Kelas A | 1356.06 | 0.46% | 1.13% | 3.04% | 3.46% | 3.82% | 35.35% | 35.61% | 29-May-2013 | 475.61M |

| Principal Index IDX30 Kelas O | 1370.85 | 0.82% | 1.63% | 3.15% | 6.94% | 2.62% | 16.95% | 37.08% | 7-Dec-2012 | 96.62M |

| Principal Indo Domestic Equity Fund | 829.02 | 0.40% | 1.69% | 3.00% | 4.19% | 1.09% | 13.44% | -17.10% | 11-Apr-2013 | 22.32M |

| Principal Islamic Equity Growth Syariah | 1243.81 | 0.33% | 2.76% | 2.58% | 2.51% | 6.76% | 9.04% | 24.38% | 10-Sep-2007 | 104.47M |

| Principal Total Return Equity Fund Kelas O | 3460.86 | 0.42% | 1.71% | 2.03% | 3.28% | 4.68% | 16.89% | 246.09% | 1-Jul-2005 | 38.66M |

| SAM Indonesian Equity Fund | 2172.62 | 0.82% | 1.77% | 6.64% | 5.66% | 13.25% | 42.06% | 126.09% | 18-Oct-2011 | 995.38M |

| Sequis Equity Maxima | 991.62 | 0.61% | 1.95% | 3.87% | 3.94% | 7.41% | 23.37% | -0.84% | 25-Aug-2016 | 1.41T |

| Syailendra Equity Opportunity Fund | 4126.43 | 0.87% | 2.00% | 6.51% | 7.68% | 11.21% | 31.47% | 312.64% | 7-Jun-2007 | 360.97M |

| Syailendra MSCI Indonesia Value Index Fund Kelas A | 1183.73 | 0.56% | 0.64% | 4.67% | 12.87% | 20.13% | 44.28% | 18.37% | 8-Jun-2018 | 743.79M |

| TRIM Kapital | 12199.19 | 0.62% | 1.85% | 7.69% | 11.44% | 14.89% | 52.03% | 1461.48% | 19-Mar-1997 | 255.84M |

| TRIM Kapital Plus | 4352.7 | 0.73% | 2.26% | 8.69% | 11.95% | 14.90% | 58.25% | 335.27% | 18-Apr-2008 | 168.59M |

| Trimegah FTSE Indonesia Low Volatility Factor Index | 1292.86 | 0.64% | 0.83% | 3.23% | 9.41% | 21.60% | - | 29.29% | 3-Nov-2020 | 33.13M |

Provided by AIT, last update 14 Juli 2023

| Inception | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Jenis | Reksa Dana USD | NAV | 1D | 1M | 3M | YTD | 1Y | 3Y | % | Date | AUM |

| Saham | Eastspring Syariah Greater China Equity USD Kelas A | 0.67 | 2.39% | 2.46% | -0.28% | -3.78% | -14.07% | -39.05% | -32.62% | 15-Jun-2020 | 9.72Jt |

| Saham | Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 0.98 | 1.25% | -0.33% | 0.06% | 1.28% | -4.84% | -18.77% | -2.23% | 28-Oct-2016 | 6.27Jt |

| Pendapatan Tetap | Eastspring Syariah Fixed Income USD Kelas A | 0.92 | 0.02% | -0.25% | -0.86% | 0.20% | -0.02% | - | -7.93% | 8-Mar-2021 | 1.03Jt |

Provided by AIT, last update 14 Juli 2023

Event Calendar

| Monday, 17 July 2023 | Previous | Consensus | Forecast | ||

| 9:00 AM | CN | GDP Growth Rate YoY Q2 | 4.50% | 7.30% | 7.10% |

| 9:00 AM | CN | Industrial Production YoY JUN | 3.50% | 2.70% | 2.40% |

| 9:00 AM | CN | Unemployment Rate JUN | 5.20% | 5.30% | |

| 9:00 AM | CN | Fixed Asset Investment (YTD) YoY JUN | 4.00% | 3.50% | 4.30% |

| 9:00 AM | CN | Retail Sales YoY JUN | 12.70% | 3.20% | 3.50% |

| 9:00 AM | CN | GDP Growth Rate QoQ Q2 | 2.20% | 0.50% | 0.80% |

| 7:30 PM | US | NY Empire State Manufacturing Index JUL | 6.6 | -4.3 | -6 |

| CN | FDI (YTD) YoY JUN | 0.10% | 0.10% | ||

| Tuesday, 18 July 2023 | Previous | Consensus | Forecast | ||

| 7:30 PM | US | Retail Sales MoM JUN | 0.30% | 0.50% | 0.30% |

| 7:30 PM | US | Retail Sales Ex Autos MoM JUN | 0.10% | 0.30% | 0.20% |

| 8:15 PM | US | Industrial Production MoM JUN | -0.20% | 0.00% | 0.20% |

| 8:15 PM | US | Industrial Production YoY JUN | 0.20% | -0.50% | |

| 9:00 PM | US | Business Inventories MoM MAY | 0.20% | 0.20% | 0.10% |

| 9:00 PM | US | NAHB Housing Market Index JUL | 55 | 56 | 56 |

| 9:00 PM | US | Fed Barr Speech | |||

| Wednesday, 19 July 2023 | Previous | Consensus | Forecast | ||

| 3:00 AM | US | Net Long-term TIC Flows MAY | $127.8B | ||

| 3:30 AM | US | API Crude Oil Stock Change JUL/14 | 3.026M | ||

| 6:00 AM | JP | Reuters Tankan Index JUL | 8 | 10 | |

| 1:00 PM | GB | Inflation Rate YoY JUN | 8.70% | 8.20% | 8.30% |

| 1:00 PM | GB | Inflation Rate MoM JUN | 0.70% | 0.40% | 0.40% |

| 1:00 PM | GB | Core Inflation Rate YoY JUN | 7.10% | 7.10% | 7.00% |

| 6:00 PM | US | MBA 30-Year Mortgage Rate JUL/14 | 7.07% | ||

| 7:30 PM | US | Building Permits Prel JUN | 1.496M | 1.5M | 1.462M |

| 7:30 PM | US | Housing Starts MoM JUN | 21.70% | -10.20% | |

| 7:30 PM | US | Building Permits MoM Prel JUN | 5.60% | -2.30% | |

| 7:30 PM | US | Housing Starts JUN | 1.631M | 1.48M | 1.465M |

| 9:30 PM | US | EIA Crude Oil Stocks Change JUL/14 | 5.946M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change JUL/14 | -0.003M | ||

| Thursday, 20 July 2023 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Balance of Trade JUN | ¥-1372.5B | ¥-46.7B | ¥ -48B |

| 6:50 AM | JP | Exports YoY JUN | 0.60% | 2.20% | 1.90% |

| 8:15 AM | CN | Loan Prime Rate 1Y | 3.55% | 3.55% | |

| 8:15 AM | CN | Loan Prime Rate 5Y JUL | 4.20% | 4.20% | |

| 1:00 PM | DE | PPI MoM JUN | -1.40% | -0.40% | -0.60% |

| 7:30 PM | US | Initial Jobless Claims JUL/15 | 237K | 242K | 242K |

| 7:30 PM | US | Philadelphia Fed Manufacturing Index JUL | -13.7 | -10.4 | -9 |

| 9:00 PM | US | Existing Home Sales MoM JUN | 0.20% | -1.20% | |

| 9:00 PM | US | Existing Home Sales JUN | 4.3M | 4.21M | 4.25M |

| Friday, 21 July 2023 | Previous | Consensus | Forecast | ||

| 6:01 AM | GB | Gfk Consumer Confidence JUL | -24 | -26 | -26 |

| 6:30 AM | JP | Inflation Rate YoY JUN | 3.20% | 3.50% | 3.30% |

| 6:30 AM | JP | Core Inflation Rate YoY JUN | 3.20% | 3.30% | 3.20% |

| 1:00 PM | GB | Retail Sales MoM JUN | 0.30% | 0.20% | 0.10% |

| 1:00 PM | GB | Retail Sales ex Fuel MoM JUN | 0.10% | 0.10% | -0.10% |

| 1:00 PM | GB | Retail Sales YoY JUN | -2.10% | -1.50% | -1.70% |

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 10 Juli 2023

- Cermati Invest Weekly Update 3 Juli 2023

- Cermati Invest Weekly Update 26 Juni 2023