| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

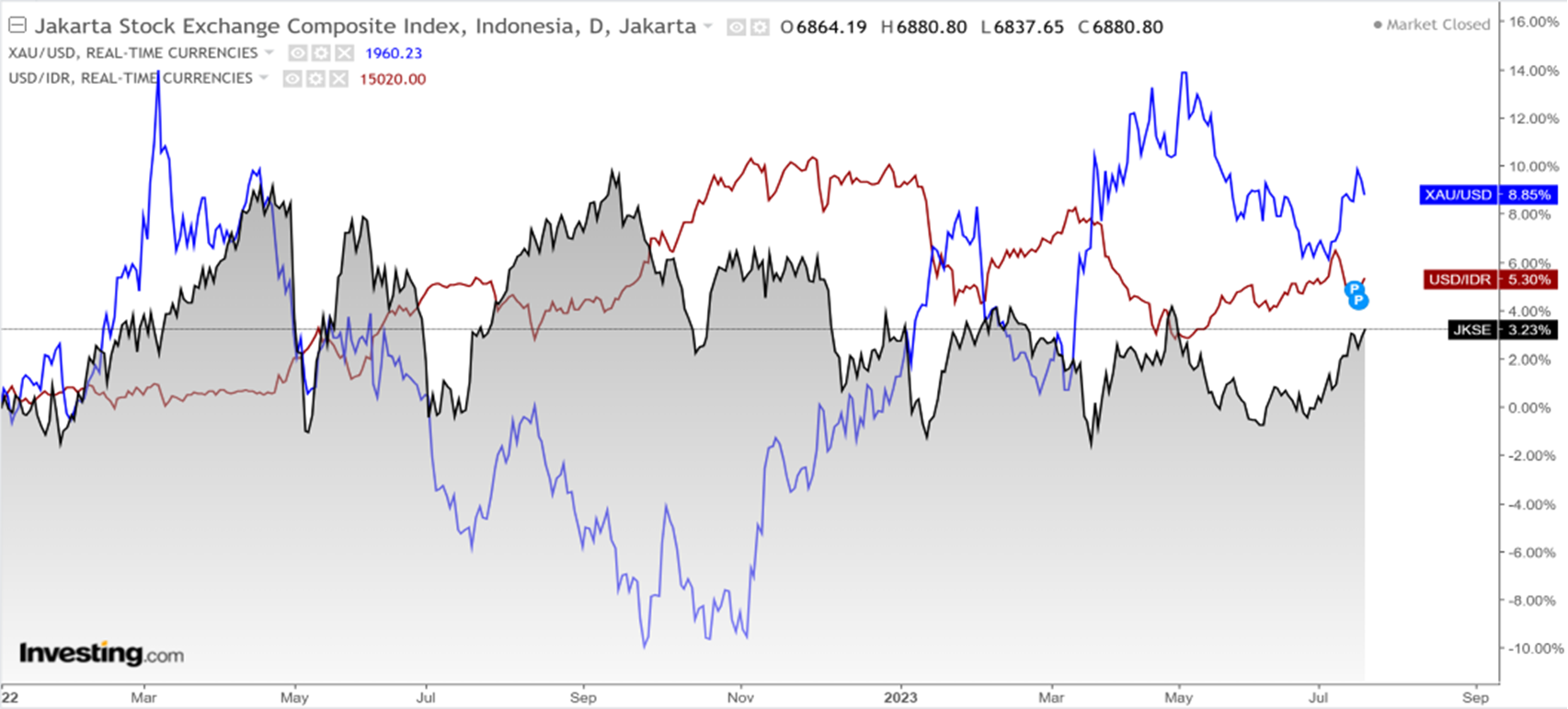

| JKSE | 0.16% | 6,880.80 |

| JKLQ45 | -0.07% | 963.38 |

| JKIDX30 | -0.04% | 500.62 |

| EIDO | -0.34% | 23.53 |

| FTSE Indonesia | 0.06% | 3,715.06 |

| USD/IDR | 0.59% | 15,043 |

Provided by AIT, last update 21 Juli 2023

Market Review

Pasar keuangan Indonesia mencatatkan kinerja beragam pada pekan lalu. Indeks Harga Saham Gabungan (IHSG) membukukan kinerja impresif sementara rupiah dan pasar Surat Berharga Negara (SBN) bergerak ke arah negatif.

Pergerakan bursa Wall Street pekan ini diperkirakan masih akan dipengaruhi oleh kinerja perusahaan serta keputusan The Fed pekan ini, Kamis pagi (WIB).

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 0.36% | 1,961.96 |

| Crude Oil WTI | 1.87% | 76.83 |

| Palm Oil c3 F | 0.36% | 3,895 |

| Natural Gas | 7.29% | 2.72 |

| Newcastle Coal | -0.49% | 131.00 |

| Nickel | -3.70% | 20,830 |

| Tin | -0.17% | 28,494 |

| Copper | -2.66% | 8,443 |

| Aluminium | -2.83% | 2,212 |

| US Soybeans | 0.16% | 1,402.00 |

Provided by AIT, last update 21 Juli 2023

Economic Data

Investor asing mencatatkan net buy dalam sepekan yakni sebesar Rp 2,73 triliun di semua pasar. Penguatan IHSG ditopang oleh sejumlah faktor mulai dari melambungnya harga komoditas. Dalam sepekan, harga batu bara sudah naik 5,78%.Sementara itu, harga minyak sawit juga melonjak hampir 4% sepekan dan harga minyak mentah naik sekitar 1% sepekan.

Sentimen positif pasar keuangan Indonesia juga datang dari data realisasi investasi. Badan Koordinasi Penanaman Modal (BKPM) mencatat realisasi kuartal II-2023 mencapai Rp 349,8 triliun. Realisasi dari investor lokal mencapai Rp 163,5 triliun atau naik 17,6% (year on year/yoy) sementara dari investor asing menyentuh Rp 186,3 triliun atau naik 14,2% (yoy).

Dari Indonesia, BI akan menggelar Rapat Dewan Gubernur (RDG) pada Senin dan Selasa pekan ini (24-25 Juli 2023) dan akan mengumumkan hasil rapat pada Selasa besok. Analis/ekonom memperkirakan jika BI masih akan menahan suku bunga di level 5,75% pada bulan ini, hal ini dikarenakan Inflasi Indonesia sudah jauh melambat dari 5,95% (yoy) pada September 2022 menjadi 3,52% (yoy) pada Juni 2023.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 2.08% | 35,227.69 |

| S&P 500 | 0.69% | 4,536.34 |

| FTSE 100 | 3.08% | 7,663.73 |

| DAX | 0.45% | 16,177.22 |

| Nikkei 225 | -0.24% | 32,314.50 |

| Hang Seng | -1.74% | 19,076.00 |

| Shanghai | -2.16% | 3,167.75 |

| KOSPI | -0.71% | 2,609.76 |

Provided by AIT, last update 21 Juli 2023

Regional Info

Pergerakan bursa Wall Street pekan ini diperkirakan masih akan dipengaruhi oleh kinerja perusahaan serta keputusan The Fed. Pekan ini juga menjadi periode yang sangat penting bagi pasar keuangan global dan Indonesia karena ada rapat FOMC pada Selasa dan Rabu (25-26 Juli) waktu AS. The Fed akan mengumumkan hasil rapat pada Rabu waktu AS atau Kamis dini hari waktu Indonesia. Berdasarkan perangkat FedWatch milik CME Group, pasar kini melihat ada probabilitas sebesar 99,2% The Fed akan menaikkan suku bunga sebesar 25 bps menjadi 5,25-5,5% pada bulan ini. Pelaku pasar berekspektasi jika kenaikan suku bunga pada Juli akan menjadi yang terakhir pada tahun ini. Pasalnya, inflasi AS sudah jauh melandai ke 3% (yoy) pada Juni tahun ini, dari 9,1% (yoy) pada Juni tahun lalu. Kebijakan The Fed ini akan ditunggu oleh pelaku pasar global dan Indonesia. Jika keputusan The Fed sesuai ekspektasi pasar maka pasar akan bergerak ke arah positif.

Dari Eropa, bank sentral Eropa (ECB) akan menggelar rapat pada Kamis (27/7/2023). ECB diproyeksi masih akan menaikkan deposit facility rate sebesar 25 bps menjadi dari 3,5% menjadi 3,75% pada pekan ini. ECB diproyeksi akan menaikkan suku bunga meskipun inflasi sudah jauh melandai menjadi 5,5% (yoy) pada Juni. Pelaku pasar pun berharap kenaikan pada Juli akan menjadi yang terakhir kali. Dari Jepang, bank sentral Jepang (BoJ) akan memutuskan kebijakan suku bunga pada Jumat pekan ini (28/7/2023). BOJ sudah menahan suku bunga ultra rendah (-0,1%) sejak 2016 atau tujuh tahun lebih.

Insight 2023 3rd Quarter, 4th week

IHSG, walau sempat naik ke 6931.27, tetapi pekan lalu tutup di 6880.80. Belum berhasil mendobrak resistance 6970, yang merupakan titik penting untuk melanjutkan uptrend. Apakah pekan ini IHSG mampu mendobrak resisten tersebut untuk menuju resistance berikutnya yaitu 7222.89 ? Support IHSG nantinya di sekitar 6718.76.

Rupiah, statistik Bank Indonesia, posisi Rupiah berada di 15065.95 (Jual) dan 14916.05 (Beli) per 1 US Dollar. Pekan ini, Rupiah bergerak dalam rentang 14919—15080 terhadap 1 Dollar Amerika (USD).

Emas, pekan lalu harga emas dunia sempat terbang nyaris 1988 per t’oz, tetapi ditutup koreksi ke 1961.96 per t’oz. Awal pekan ini kemungkian terkoreksi, tetapi tetap nantinya kembali naik menuju 1992 per t’oz, dengan Support nantinya di sekitar 1933.15 per t’oz. Dalam kurs rupiah, berkisar 937360—965895 per gram.

IHSG masih diharapkan untuk menembus resisten (6970) yang selama ini tidak pernah mampu ditembus ke atas, memberi kesempatan bagi Reksa Dana Saham untuk bergerak lebih tinggi, terutama yang berbasis indeks atau top 10 stock universe dari indeks Srikehati, MNC36, FTSE Indonesia, MSCI Indonesia.

Source : BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM |

| Batavia Dana Dinamis | 9388.16 | 0.23% | 0.83% | 4.17% | 5.71% | 8.08% | 29.86% | 838.82% | 3-Jun-02 | 367.44M |

| SAM Mutiara Nusantara Nusa Campuran | 1859.06 | 0.45% | 0.58% | 1.54% | 8.49% | 5.80% | 51.67% | 85.91% | 21-Dec-17 | 28.99M |

| Setiabudi Dana Campuran | 1360.05 | 0.48% | 2.50% | 3.39% | 7.00% | 8.83% | 55.65% | 36.00% | 25-Sep-17 | 59.18M |

| TRIM Kombinasi 2 | 2659.61 | 0.33% | 3.44% | 8.07% | 7.44% | 7.00% | 32.32% | 165.96% | 10-Nov-06 | 23.54M |

| TRIM Syariah Berimbang | 3109.43 | 0.31% | 2.16% | 4.30% | 6.41% | 3.70% | 24.96% | 210.94% | 27-Dec-06 | 19.84M |

| Trimegah Balanced Absolute Strategy Kelas A | 1718.15 | 0.28% | 3.29% | 8.00% | 8.00% | 5.30% | 51.92% | 71.81% | 28-Dec-18 | 288.64M |

Provided by AIT, last update 21 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM |

| Bahana Likuid Syariah Kelas G | 1122.96 | 0.01% | 0.34% | 1.04% | 2.20% | 3.56% | 10.52% | 12.30% | 12-Jul-16 | 773.5M |

| BNI-AM Dana Lancar Syariah | 1674.97 | 0.01% | 0.33% | 1.13% | 2.21% | 3.45% | 10.89% | 64.27% | 28-Jun-13 | 142.05M |

| Cipta Dana Cash | 1584.77 | 0.01% | 0.33% | 1.16% | 2.46% | 4.43% | 13.16% | 58.48% | 8-Jun-15 | 190.18M |

| Danakita Stabil Pasar Uang | 1503.99 | 0.01% | 0.38% | 1.15% | 2.42% | 3.97% | 13.12% | 50.40% | 10-Sep-15 | 164.78M |

| Danareksa Seruni Pasar Uang III | 1637.04 | 0.01% | 0.33% | 1.11% | 2.22% | 3.40% | 11.83% | 63.70% | 16-Feb-10 | 2.3T |

| HPAM Ultima Money Market | 1501.31 | 0.01% | 0.33% | 1.12% | 2.53% | 4.20% | 14.71% | 50.13% | 10-Jun-15 | 753.19M |

| Insight Retail Cash Fund | 1468.17 | 0.01% | 0.41% | 1.38% | 2.57% | 3.98% | 13.59% | 46.82% | 13-Apr-18 | 2.95M |

| SAM Dana Kas | 1347.37 | 0.02% | 0.33% | 1.09% | 2.31% | 3.36% | 10.63% | 34.74% | 10-Feb-17 | 196.79M |

| Setiabudi Dana Pasar Uang | 1395.33 | 0.01% | 0.38% | 1.19% | 2.44% | 4.01% | 13.12% | 39.53% | 23-Dec-16 | 619.05M |

| Syailendra Dana Kas | 1574.35 | 0.01% | 0.35% | 1.08% | 2.29% | 4.08% | 13.24% | 57.44% | 12-Jun-15 | 4.01T |

| TRIM Kas 2 Kelas A | 1767.68 | 0.01% | 0.35% | 1.09% | 2.28% | 3.95% | 12.76% | 76.77% | 8-Apr-08 | 3.32T |

| Trimegah Kas Syariah | 1327.13 | 0.01% | 0.35% | 1.10% | 2.30% | 3.97% | 11.47% | 32.71% | 30-Dec-16 | 434.95M |

Provided by AIT, last update 21 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM |

| Bahana Mes Syariah Fund Kelas G | 1491.88 | 0.03% | 0.20% | 3.53% | 4.90% | 7.73% | 18.24% | 49.19% | 11-Nov-16 | 607.12M |

| BNI-AM Dana Pendapatan Tetap Nirwasita | 1615.59 | -0.09% | 0.68% | 3.60% | 6.76% | 11.61% | 22.66% | 61.56% | 16-Jun-16 | 68.11M |

| BNI-AM Dana Pendapatan Tetap Syariah Ardhani | 1579.36 | 0.02% | 0.30% | 3.90% | 6.29% | 8.30% | 21.73% | 57.94% | 16-Aug-16 | 316.02M |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1057.69 | -0.06% | 0.22% | 2.38% | 4.82% | - | - | 7.60% | 1-Sep-22 | 5.46M |

| Cipta Bond | 1726.5 | 0.02% | 0.02% | 1.34% | 3.44% | 7.42% | 15.52% | 70.13% | 2-Jan-19 | 23.84M |

| Eastspring IDR Fixed Income Fund Kelas A | 1689.22 | -0.08% | 0.60% | 3.29% | 5.50% | 10.36% | 19.45% | 68.92% | 16-Mar-15 | 131.92M |

| Eastspring Investments IDR High Grade Kelas A | 1640.96 | -0.17% | 0.63% | 3.07% | 5.41% | 11.12% | 16.43% | 64.10% | 9-Jan-13 | 25.72M |

| HPAM Government Bond | 1533.43 | -0.10% | 0.39% | 3.18% | 5.81% | 10.33% | 18.48% | 53.34% | 18-May-16 | 21.06M |

| Insight Haji Syariah | 4594.8 | 0.02% | 0.57% | 1.82% | 4.03% | 7.24% | 24.88% | 359.48% | 13-Jan-05 | 1.61T |

| Principal Income Fund Syariah | 1103.99 | -0.07% | 0.00% | 4.77% | 5.67% | 7.72% | - | 10.40% | 21-Oct-20 | 3.39M |

| SAM Sukuk Syariah Sejahtera | 2486.11 | 0.02% | 0.70% | 2.20% | 4.89% | 7.15% | 20.23% | 165.59% | 29-Oct-97 | 54.14M |

| Syailendra Fixed Income Fund | 2499.02 | -0.02% | 0.44% | 2.89% | 5.71% | 10.55% | 17.39% | 149.90% | 8-Dec-11 | 243.11M |

Provided by AIT, last update 21 Juli 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1D | 1M | 3M | YtD | 1Y | 3Y | % | Date | AUM (M) |

| Batavia Dana Saham | 64165.25 | 0.42% | 0.83% | 4.62% | 5.02% | 7.04% | 27.28% | 2435.00% | 16-Dec-96 | 4.17T |

| Batavia Dana Saham Optimal | 3274.73 | 0.47% | 1.14% | 5.70% | 6.55% | 7.04% | 38.18% | 227.47% | 19-Oct-06 | 661.93M |

| Batavia Disruptive Equity | 1051.02 | 0.20% | 0.84% | 5.79% | 8.04% | 7.99% | - | 5.10% | 15-Dec-21 | 46.2M |

| BNI-AM Indeks IDX Growth30 Kelas R1 | 1162.32 | 0.37% | 2.37% | 1.85% | 5.27% | 9.35% | - | 16.23% | 27-Jan-22 | 810.36Jt |

| BNI-AM Indeks IDX30 | 893.6 | 0.20% | 1.10% | 3.45% | 6.92% | 0.48% | 21.22% | -7.94% | 28-Dec-17 | 1.69T |

| Cipta Rencana Cerdas | 18675.68 | 0.25% | 2.67% | 7.12% | 8.82% | 13.49% | 46.52% | 2629.05% | 9-Jul-99 | 107.3M |

| Cipta Saham Unggulan | 3179.65 | -0.03% | 5.43% | 12.26% | 14.89% | 18.92% | 88.15% | 217.96% | 4-Dec-18 | 51.63M |

| Cipta Saham Unggulan Syariah | 2701.72 | -0.02% | 6.82% | 14.20% | 15.75% | 15.40% | 80.78% | 170.17% | 5-Sep-18 | 20.57M |

| Danakita Saham Prioritas | 1185.55 | 0.56% | 1.30% | 3.28% | 7.79% | 12.47% | 34.93% | 18.55% | 17-Oct-18 | 11.27M |

| Eastspring Investments Alpha Navigator Kelas A | 1564.77 | 0.30% | 1.21% | 4.36% | 5.71% | 7.67% | 35.16% | 56.48% | 29-Aug-12 | 127.36M |

| Principal Index IDX30 Kelas O | 1369.65 | 0.20% | 1.06% | 3.39% | 6.85% | 0.16% | 16.26% | 36.96% | 7-Dec-12 | 96.62M |

| SAM Indonesian Equity Fund | 2177.79 | 0.19% | 2.25% | 6.60% | 5.91% | 8.77% | 41.75% | 126.60% | 18-Oct-11 | 995.38M |

| Sequis Equity Maxima | 992.64 | 0.34% | 1.73% | 4.21% | 4.04% | 4.51% | 22.26% | -0.74% | 25-Aug-16 | 1.41T |

| Syailendra Equity Opportunity Fund | 4116.53 | 0.25% | 1.44% | 6.38% | 7.42% | 6.42% | 30.08% | 311.65% | 7-Jun-07 | 360.97M |

| Syailendra MSCI Indonesia Value Index Fund Kelas A | 1185.87 | 0.16% | 0.52% | 5.49% | 13.08% | 15.17% | 41.85% | 18.59% | 8-Jun-18 | 743.79M |

| TRIM Kapital | 12265.73 | -0.01% | 1.29% | 7.76% | 12.04% | 11.93% | 51.37% | 1469.99% | 19-Mar-97 | 255.84M |

| TRIM Kapital Plus | 4385.74 | 0.02% | 1.86% | 8.95% | 12.80% | 12.15% | 57.67% | 338.57% | 18-Apr-08 | 168.59M |

| Trimegah FTSE Indonesia Low Volatility Factor Index | 1290.23 | 0.24% | 0.23% | 3.03% | 9.19% | 16.08% | - | 29.02% | 3-Nov-20 | 33.13M |

Provided by AIT, last update 21 Juli 2023

Event Calendar

| Monday, 24 July 2023 | Previous | Consensus | Forecast | ||

| 7:30 AM | JP | Jibun Bank Manufacturing PMI Flash JUL | 49.8 | 49.8 | 50.0 |

| 7:30 AM | JP | Jibun Bank Services PMI Flash JUL | 54.0 | 53.4 | |

| 2:30 PM | DE | HCOB Manufacturing PMI Flash JUL | 40.6 | 41.0 | 40.0 |

| 2:30 PM | DE | HCOB Services PMI Flash JUL | 54.1 | 53.1 | 52.9 |

| 3:30 PM | GB | S&P Global/CIPS Manufacturing PMI Flash JUL | 46.5 | 46.1 | 46.0 |

| 3:30 PM | GB | S&P Global/CIPS Services PMI Flash JUL | 53.7 | 53.0 | 53.0 |

| 7:30 PM | US | Chicago Fed National Activity Index JUN | -0.15 | 0.0 | 0.20 |

| 8:45 PM | US | S&P Global Manufacturing PMI Flash JUL | 46.3 | 46.4 | 46.0 |

| 8:45 PM | US | S&P Global Composite PMI Flash JUL | 53.2 | 52.6 | |

| 8:45 PM | US | S&P Global Services PMI Flash JUL | 54.4 | 54.0 | 54.0 |

| Tuesday, 25 July 2023 | Previous | Consensus | Forecast | ||

| 2:30 PM | ID | Interest Rate Decision | 5.75% | 5.75% | 5.75% |

| 3:00 PM | DE | Ifo Business Climate JUL | 88.4 | 88.0 | 87.6 |

| 5:00 PM | GB | CBI Business Optimism Index Q3 | -2 | 5 | |

| 5:00 PM | GB | CBI Industrial Trends Orders JUL | -15 | -12 | |

| 8:00 PM | US | S&P/Case-Shiller Home Price YoY MAY | -1.70% | -2.20% | -2.00% |

| 8:00 PM | US | S&P/Case-Shiller Home Price MoM MAY | 1.70% | 1.20% | 1.90% |

| 9:00 PM | US | CB Consumer Confidence JUL | 109.7 | 111.5 | 111 |

| Wednesday, 26 July 2023 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change JUL/21 | -0.797M | ||

| 6:00 PM | US | MBA 30-Year Mortgage Rate JUL/21 | 6.87% | ||

| 9:00 PM | US | New Home Sales MoM JUN | 12.20% | -4.00% | |

| 9:00 PM | US | New Home Sales JUN | 0.763M | 0.727M | 0.69M |

| 9:30 PM | US | EIA Crude Oil Stocks Change JUL/21 | -0.708M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change JUL/21 | -1.066M | ||

| Thursday, 27 July 2023 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | Fed Interest Rate Decision | 5.25% | 5.50% | 5.50% |

| 1:30 AM | US | Fed Press Conference | |||

| 1:00 PM | DE | GfK Consumer Confidence AUG | -25.4 | -24.7 | -24 |

| 5:00 PM | GB | CBI Distributive Trades JUL | -9 | -2 | |

| 7:30 PM | US | Durable Goods Orders MoM JUN | 1.70% | 0.70% | 0.60% |

| 7:30 PM | US | GDP Growth Rate QoQ Adv Q2 | 2.00% | 1.70% | 1.80% |

| 7:30 PM | US | GDP Price Index QoQ Adv Q2 | 4.10% | 3.00% | 3.60% |

| 7:30 PM | US | Durable Goods Orders Ex Transp MoM JUN | 0.60% | 0.10% | -0.20% |

| 7:30 PM | US | Initial Jobless Claims JUL/22 | 228K | 235K | 231.0K |

| 9:00 PM | US | Pending Home Sales MoM JUN | -2.70% | -0.60% | -0.70% |

| Friday, 28 July 2023 | Previous | Consensus | Forecast | ||

| 10:00 AM | JP | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% |

| 7:00 PM | DE | Inflation Rate YoY Prel JUL | 6.40% | 6.20% | 6.10% |

| 7:00 PM | DE | Inflation Rate MoM Prel JUL | 0.30% | 0.30% | 0.20% |

| 7:30 PM | US | Core PCE Price Index MoM JUN | 0.30% | 0.20% | 0.20% |

| 7:30 PM | US | Personal Spending MoM JUN | 0.10% | 0.40% | 0.30% |

| 7:30 PM | US | Personal Income MoM JUN | 0.40% | 0.50% | 0.40% |

| 7:30 PM | US | Employment Cost Index QoQ Q2 | 1.20% | 1.10% | 1.10% |

| 9:00 PM | US | Michigan Consumer Sentiment Final JUL | 64.4 | 72.6 | 72.6 |

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 17 Juli 2023

- Cermati Invest Weekly Update 10 Juli 2023

- Cermati Invest Weekly Update 3 Juli 2023