| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IDX Composite | -0.76% | 6,982.79 |

| IDX LQ45 | -1.51% | 961.20 |

| IDX 30 | -1.44% | 497.95 |

| MSCI Indonesia | -1.67% | 7,533.38 |

| FTSE Indonesia | -1.62% | 3,677.48 |

| USD/IDR | 0.96% | 15,364.60 |

Provided by AIT, last update 15 September 2023

Market Review

IHSG masih diwarnai aksi jual dari investor asing, akibat ketidakpastian pasar global, dan investor juga menunggu arah kebijakan suku bunga Bank Indonesia. Dari pasar global, sentiment datang dari harga minyak yang melonjak dan arah kebijakan moneter dari Amerika & China.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | -1.01% | 1,923.81 |

| Crude Oil WTI | 1.96% | 91.20 |

| Palm Oil c3 F | -5.20% | 3,785 |

| Natural Gas | -5.32% | 2.64 |

| Newcastle Coal | -0.16% | 160.50 |

| Nickel | -4.96% | 19,923 |

| Tin | -0.90% | 25,703 |

| Copper | -3.17% | 8,410 |

| Aluminium | -2.37% | 2,195 |

| US Soybeans | -0.38% | 1,338.50 |

Provided by AIT, last update 15 September 2023

Economic Data

Investor asing tampak agresif melepas saham di Bursa Efek Indonesia (BEI). Nilai transaksi jual bersih (net sell) asing di seluruh pasar makin membesar mencapai Rp4,1 triliun sepanjang tahun berjalan ini akibat dari ketidakpastian dari pasar global. Sementara itu, dalam sepekan terakhir, asing juga terpantau lebih banyak jual. Net sell terbesar di pasar reguler dalam sepekan dialami sejumlah saham yang selama ini populer di kalangan pemodal, yaitu PT Bank Central Asia Tbk (BBCA) senilai Rp802,4 miliar, PT Merdeka Copper Gold Tbk (MDKA) Rp176,9 miliar, PT Bank Rakyat Indonesia Tbk (BBRI) Rp139,3 miliar, dan PT GoTo Gojek Tokopedia Tbk (GOTO) Rp133 miliar.

Sementara itu dari Indonesia, pada pekan depan, Bank Indonesia (BI) juga akan mengumumkan kebijakan suku bunga acuan terbarunya. BI akan menggelar Rapat Dewan Gubernur (RDG) pada 20-21 September dan akan mengumumkan hasilnya pada Kamis, 21 September siang. Konsensus pasar dalam Reuters memperkirakan BI akan kembali mempertahankan suku bunga acuannya di level 5,75%. Jika ekspektasi pasar tersebut benar, maka BI sudah menahan suku bunga acuannya selama tujuh bulan terakhir.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | -0.75% | 34,618.24 |

| S&P 500 | -1.29% | 4,450.32 |

| FTSE 100 | 0.18% | 7,711.38 |

| DAX | -0.63% | 15,893.53 |

| Nikkei 225 | -0.31% | 33,582.50 |

| Hang Seng | -0.98% | 18,238.50 |

| Shanghai | -0.53% | 3,117.74 |

| KOSPI | -0.63% | 2,601.28 |

Provided by AIT, last update 15 September 2023

Regional Info

Harga minyak mentah dunia ditutup melesat pada penutupan perdagangan Jumat (15/9/2023) melanjutkan trend kenaikan selama sepekan karena terbatasnya pasokan dan optimisme di China. Pada hari Jumat harga minyak mentah WTI ditutup terapresiasi 0,68% di posisi US$ 90,77 per barel, begitu juga dengan minyak mentah brent ditutup naik 0,25% di posisi US$ 93,93 per barel. Kekhawatiran pasokan terus menjadi pendorong harga minyak sejak Arab Saudi dan Rusia bulan ini mengumumkan perpanjangan pengurangan pasokan gabungan sebesar 1,3 juta barel per hari hingga akhir tahun 2023. Data output industri dan penjualan ritel yang lebih baik dari perkiraan di China juga telah mendorong harga minyak pada minggu ini, dengan kondisi ekonomi negara tersebut dianggap penting untuk permintaan minyak selama sisa tahun ini.

Pekan ini pelaku pasar perlu memperhatikan secara cermat pertemuan bank sentral Amerika Serikat (AS) terkait kebijakan moneter terbaru edisi September. Pada Rabu malam waktu Indonesia pekan lalu, inflasi konsumen ( consumer price index/CPI) Amerika Serikat bulan Agustus kembali naik menjadi 3,7% secara tahunan (year-on-year/yoy), dari sebelumnya pada Juli lalu sebesar 3,2% (yoy). Data inflasi AS membuat prospek berakhirnya era suku bunga tinggi dipertaruhkan, karena The Fed berpotensi masih akan mempertahankan sikap hawkish-nya hingga inflasi menyentuh target yang ditetapkan di 2%.

Pada pekan ini, bank sentral China (People's Bank of China/PBoC) juga akan mengumumkan kebijakan suku bunga terbarunya. Pemerintah China saat ini sedang berupaya untuk membangkitkan kembali perekonomiannya yang masih lesu, meski beberapa data ekonomi sudah ada tanda perbaikan. Contohnya saja inflasi China, di mana inflasinya pada periode Agustus 2023 sudah terlepas dari deflasi yakni tumbuh 0,1% (yoy). Adapun pada Juli lalu, China mengalami deflasi yakni mencapai -0,3% (yoy).

Insight 2023 3rd Quarter, 12th week

IHSG, minggu lalu sempat mencapai 7011.88, walau tutup di 6982.79, IHSG masih bertahan di area 6847 (support)—7032 (resistant). Resisten berikutnya 7118.

RUPIAH, arahnya melemah, tujuan 15759, walau sulit untuk saat ini, tetapi bila ada penguatan terbatas hanya sampai 15255

EMAS, diperkirakan akan melanjutkan penguatan ke kisaran 1953 us dollar per troyounce, kalaupun melemah 1903 US dollar per troyounce. Dalam rupiah harga emas logam mulia di kisaran Rp. 1.004.319,- (diluar biaya-biaya). Untuk emas perhiasan di sekitar Rp. 753.239,- per gram (diluar biaya pembuatan)

CERMATI, indeks Srikehati, Bisnis 27, FTSE Indonesia, MSCI Indonesia. Untuk sektor pertambangan masih mendominasi sejak 2022.

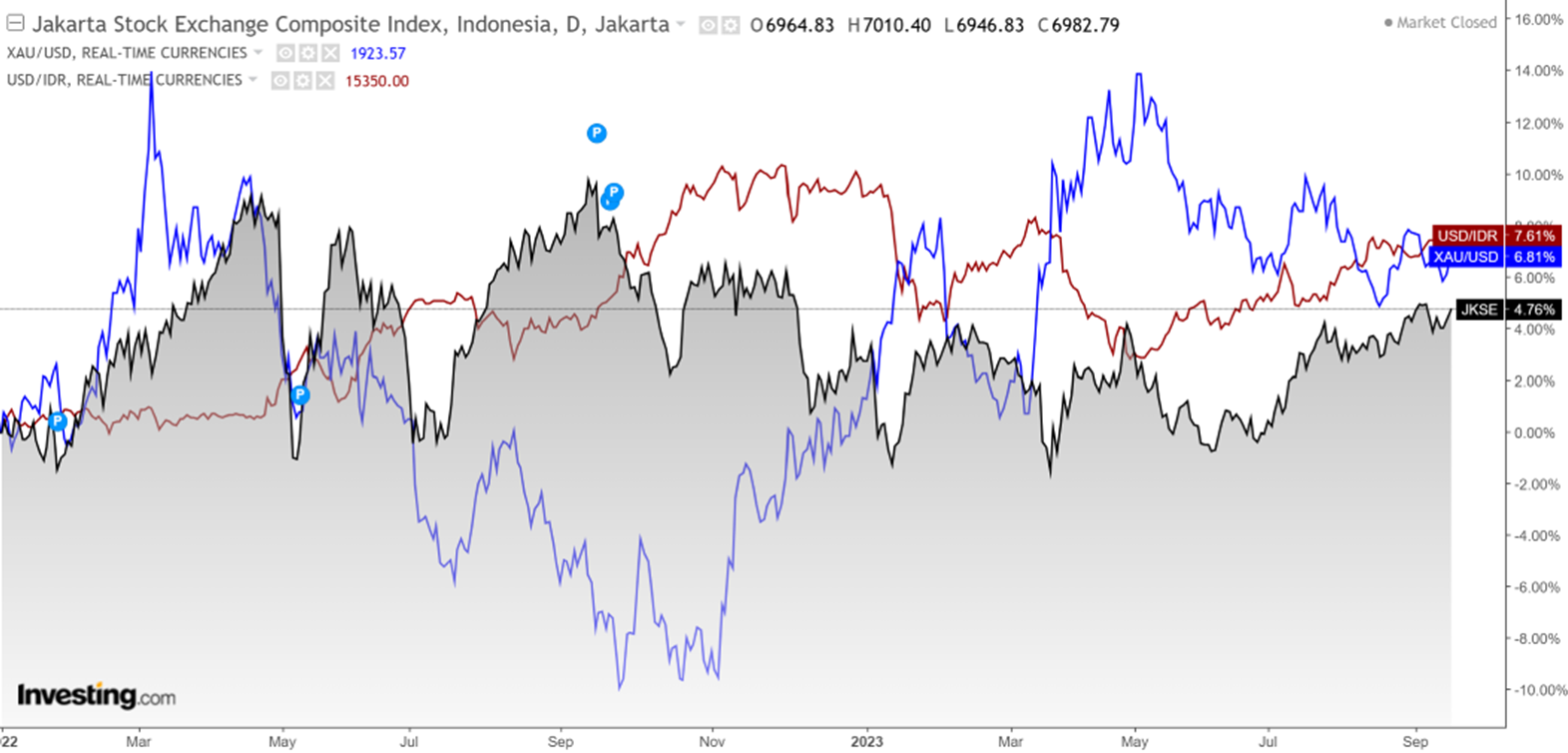

USDIDR & GOLD compare to COMPOSITE INDEX (Daily Performance) since 2022

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Trimegah Balanced Absolute Strategy Kelas A | 1827.24 | 4.70% | 9.12% | 14.70% | 14.86% | 4.39% | 56.91% | 82.72% | 28 Dec 2018 | 295M |

| Trim Kombinasi 2 | 2808.86 | 4.37% | 8.56% | 13.39% | 13.47% | 4.18% | 41.07% | 180.89% | 10 Nov 2006 | 24M |

| Sam Mutiara Nusantara Nusa Campuran | 1918.0802 | 4.09% | 3.61% | 8.29% | 11.93% | 3.66% | 49.92% | 91.81% | 21 Dec 2017 | 29M |

| Trim Syariah Berimbang | 3297.76 | 3.82% | 8.06% | 14.02% | 12.85% | 3.34% | 30.57% | 229.78% | 27 Dec 2006 | 20M |

| Hpam Flexi Plus | 1600.8281 | 3.31% | 1.63% | 1.89% | -1.61% | -6.57% | 1.98% | 60.08% | 2 Mar 2011 | 40M |

| Syailendra Balanced Opportunity Fund | 3236.06 | 1.29% | 5.68% | 5.85% | 5.68% | -4.19% | 43.03% | 223.61% | 22 Apr 2008 | 103M |

| Setiabudi Dana Campuran | 1390.8419 | 0.91% | 5.26% | 10.57% | 9.42% | 5.15% | 56.07% | 39.08% | 25 Sep 2017 | 61M |

| Sequis Balance Ultima | 1238.1192 | 0.34% | 1.72% | 7.01% | 6.05% | 3.54% | 20.39% | 23.81% | 8 Sep 2016 | 139M |

| Batavia Dana Dinamis | 9345.96 | -0.70% | 0.27% | 6.30% | 5.23% | 2.09% | 28.50% | 834.60% | 3 Jun 2002 | 438M |

Provided by AIT, last update 15 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Setiabudi Dana Pasar Uang | 1405.4958 | 0.41% | 1.19% | 2.33% | 3.19% | 4.26% | 12.98% | 40.55% | 23 Dec 2016 | 686M |

| Danakita Stabil Pasar Uang | 1514.59 | 0.38% | 1.16% | 2.28% | 3.14% | 4.18% | 13.05% | 51.46% | 10 Sep 2015 | 129M |

| Hpam Ultima Money Market | 1511.1529 | 0.37% | 1.06% | 2.29% | 3.20% | 4.33% | 14.51% | 51.12% | 10 Jun 2015 | 623M |

| Trimegah Kas Syariah | 1335.7733 | 0.36% | 1.08% | 2.14% | 2.97% | 4.13% | 11.54% | 33.58% | 30 Dec 2016 | 378M |

| Trim Kas 2 Kelas A | 1779.1854 | 0.36% | 1.07% | 2.13% | 2.95% | 4.08% | 12.74% | 77.92% | 8 Apr 2008 | 3742M |

| Cipta Dana Cash | 1594.4 | 0.35% | 0.97% | 2.11% | 3.09% | 4.28% | 13.14% | 59.44% | 8 Jun 2015 | 146M |

| Sequis Liquid Prima | 1351.2548 | 0.34% | 1.06% | 2.11% | 2.82% | 3.47% | 9.38% | 35.13% | 8 Sep 2016 | 41M |

| Bahana Likuid Syariah Kelas G | 1129.91 | 0.34% | 1.03% | 2.04% | 2.83% | 3.80% | 10.42% | 12.99% | 12 Jul 2016 | 176M |

| Syailendra Dana Kas | 1583.6728 | 0.31% | 1.02% | 2.08% | 2.89% | 4.12% | 12.93% | 58.37% | 12 Jun 2015 | 3871M |

| Insight Retail Cash Fund | 1476.422 | 0.28% | 1.05% | 2.40% | 3.15% | 3.99% | 13.28% | 47.64% | 13 Apr 2018 | 3M |

Provided by AIT, last update 15 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Insight Haji Syariah | 4637.5111 | 0.46% | 1.61% | 3.50% | 5% | 6.99% | 23.23% | 363.75% | 13 Jan 2005 | 1947M |

| Trim Dana Tetap 2 | 2999.74 | 0.44% | 1.42% | 2.84% | 3.21% | 4.40% | 16.58% | 199.97% | 13 May 2008 | 546M |

| Trimegah Fixed Income Plan | 1145.1121 | 0.42% | 1.40% | 3.07% | 4.44% | 5.96% | 19.64% | 14.51% | 23 May 2019 | 4891M |

| Bni-Am Short Duration Bonds Index Kelas R1 | 1051.22 | -0.40% | -0.60% | 3.82% | 4.19% | 6.61% | - | 5.12% | 1 Sep 2022 | 4M |

| Bni-Am Dana Pendapatan Tetap Syariah Ardhani | 1571.78 | -0.61% | 0.08% | 4.29% | 5.78% | 6.53% | 18.13% | 57.18% | 16 Aug 2016 | 384M |

| Syailendra Fixed Income Fund | 2472.58 | -0.68% | -0.68% | 2.84% | 4.60% | 7.43% | 14.20% | 147.26% | 8 Dec 2011 | 192M |

| Hpam Government Bond | 1516.8174 | -0.71% | -0.88% | 3.25% | 4.67% | 7.26% | 14.47% | 51.68% | 18 May 2016 | 20M |

| Bni-Am Dana Pendapatan Tetap Nirwasita | 1594.29 | -1% | -0.90% | 3.44% | 5.35% | 7.92% | 18.44% | 59.43% | 16 Jun 2016 | 79M |

| Principal Income Fund Syariah | 1095.8 | -1.01% | -0.20% | 4.48% | 4.89% | 7.50% | - | 9.58% | 21 Oct 2020 | 3M |

Provided by AIT, last update 15 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Hpam Ultima Ekuitas 1 | 2734.9814 | 9.07% | 12.85% | 14.45% | 10.59% | 2.08% | 41.05% | 173.50% | 2 Nov 2009 | 680M |

| Sam Indonesian Equity Fund | 2327.88 | 5.85% | 11.09% | 23.40% | 15.83% | 5.57% | 56.02% | 132.79% | 18 Oct 2011 | 1025M |

| Trim Syariah Saham | 2030.47 | 4.10% | 8.40% | 13.74% | 11.73% | 0.26% | 28.56% | 103.05% | 27 Dec 2006 | 95M |

| Bahana Primavera 99 Kelas G | 1352.97 | 1.83% | 3.79% | 10.53% | 6.77% | 0.21% | 25.91% | 35.30% | 5 Sep 2014 | 25M |

| Eastspring Investments Alpha Navigator Kelas A | 1600.92 | 0.63% | 3.15% | 11.07% | 8.15% | 2.36% | 38.71% | 60.09% | 29 Aug 2012 | 102M |

| Trim Kapital Plus | 4461.54 | 0.61% | 4.30% | 15.39% | 14.75% | 3.12% | 60.48% | 346.15% | 18 Apr 2008 | 213M |

| Trim Kapital | 12416.88 | 0.43% | 3.20% | 13.71% | 13.42% | 2.49% | 57.52% | 1141.69% | 19 Mar 1997 | 348M |

| Syailendra Equity Opportunity Fund | 4175.24 | 0.34% | 2.81% | 13.01% | 8.95% | 1.57% | 34.19% | 317.52% | 7 Jun 2007 | 333M |

| Batavia Disruptive Equity | 1065.43 | 0.29% | 1.94% | 11.30% | 9.52% | 3.60% | - | 6.54% | 15 Dec 2021 | 34M |

| Danakita Saham Prioritas | 1186.21 | 0.04% | 0.92% | 10.07% | 7.85% | 4.62% | 33.02% | 18.62% | 17 Oct 2018 | 11M |

| Principal Index Idx30 Kelas O | 1360.12 | -0.68% | 0.54% | 8.21% | 6.10% | -6.45% | 17.92% | 36.01% | 7 Dec 2012 | 85M |

| Bni-Am Indeks Idx30 | 858.22 | -0.70% | 0.56% | 8.22% | 6.15% | -6.28% | 21.42% | -14.18% | 28 Dec 2017 | 1665M |

| Syailendra Msci Indonesia Value Index Fund Kelas A | 1181.42 | -1.16% | 0.14% | 14.36% | 12.65% | 4.94% | 39.43% | 18.14% | 8 Jun 2018 | 718M |

| Uobam Indeks Bisnis-27 | 1441.4162 | -1.46% | 0.72% | 8.88% | 5.87% | 1.19% | 34.96% | 44.14% | 15 Aug 2012 | 12M |

| Cipta Rencana Cerdas | 18256.7 | -1.97% | 0.60% | 10.05% | 6.38% | 1.74% | 44.08% | 1725.67% | 9 Jul 1999 | 110M |

| Insight Sri Kehati Likuid - I Sri Likuid | 1204.18 | -2.05% | -0.59% | 10.68% | 9.09% | 4.85% | 41% | 20.42% | 29 Mar 2018 | 74M |

| Trimegah Ftse Indonesia Low Volatility Factor Index | 1266.9552 | -2.22% | -1.33% | 9.19% | 7.22% | 3.42% | - | 26.70% | 3 Nov 2020 | 28M |

| Cipta Saham Unggulan | 3038.08 | -2.55% | 1.74% | 12.08% | 9.77% | 5.58% | 78.30% | 203.81% | 4 Dec 2018 | 73M |

| Cipta Saham Unggulan Syariah | 2531.79 | -4.65% | 0.69% | 10.93% | 8.47% | 0.74% | 77.83% | 153.18% | 5 Sep 2018 | 26M |

Provided by AIT, last update 15 September 2023

Event Calendar

| Monday, 18 September 2023 | Previous | Consensus | Forecast | ||

| 4:30 PM | DE | 12-Month Bubill Auction | 3.61% | ||

| 9:00 PM | US | NAHB Housing Market Index SEP | 50 | 50 | 51 |

| 10:30 PM | US | 3-Month Bill Auction | 5.32% | ||

| 10:30 PM | US | 6-Month Bill Auction | 5.30% | ||

| Tuesday, 19 September 2023 | Previous | Consensus | Forecast | ||

| 7:30 PM | US | Building Permits Prel AUG | 1.443M | 1.44M | 1.43M |

| 7:30 PM | US | Housing Starts MoM AUG | 3.90% | -2.50% | |

| 7:30 PM | US | Building Permits MoM Prel AUG | 0.10% | -1.30% | |

| 7:30 PM | US | Housing Starts AUG | 1.452M | 1.44M | 1.42M |

| Wednesday, 20 September 2023 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Balance of Trade AUG | ¥-78.7B | ¥-659.1B | ¥-950.0B |

| 6:50 AM | JP | Exports YoY AUG | -0.30% | -1.70% | -1.40% |

| 6:50 AM | JP | Imports YoY AUG | -13.50% | -19.40% | -18.00% |

| 8:15 AM | CN | Loan Prime Rate 1Y | 3.45% | 3.45% | |

| 8:15 AM | CN | Loan Prime Rate 5Y SEP | 4.20% | 4.20% | |

| 1:00 PM | DE | PPI MoM AUG | -1.10% | 0.20% | 0.20% |

| 1:00 PM | DE | PPI YoY AUG | -6% | -12.80% | -12.70% |

| 1:00 PM | GB | Inflation Rate YoY AUG | 6.80% | 7.10% | 7.10% |

| 1:00 PM | GB | Inflation Rate MoM AUG | -0.40% | 0.70% | 0.80% |

| 1:00 PM | GB | Core Inflation Rate YoY AUG | 6.90% | 6.80% | 6.70% |

| 1:00 PM | GB | Retail Price Index YoY AUG | 9% | 9.30% | 9.20% |

| Thursday, 21 September 2023 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | Fed Interest Rate Decision | 5.50% | 5.50% | 5.50% |

| 1:00 AM | US | FOMC Economic Projections | |||

| 1:00 AM | US | Interest Rate Projection - Longer | 2.50% | ||

| 1:00 AM | US | Interest Rate Projection - Current | 5.60% | ||

| 1:30 AM | US | Fed Press Conference | |||

| 10:35 AM | JP | 3-Month Bill Auction | -0.14% | ||

| 1:00 PM | GB | Public Sector Net Borrowing Ex Banks AUG | £-4.301B | £-11.05B | £-13.4B |

| 2:20 PM | ID | Loan Growth YoY AUG | 8.54% | ||

| 2:30 PM | ID | Interest Rate Decision | 5.75% | 5.75% | 5.75% |

| 6:00 PM | GB | BoE Interest Rate Decision | 5.25% | 5.50% | 5.50% |

| 7:30 PM | US | Current Account Q2 | $-219.3B | $-221.2B | $-220B |

| 7:30 PM | US | Initial Jobless Claims SEP/16 | 220K | 225K | 222.0K |

| 9:00 PM | US | Existing Home Sales MoM AUG | -2.20% | 1.50% | |

| 9:30 PM | US | EIA Natural Gas Stocks Change SEP/15 | 57Bcf | ||

| 10:30 PM | US | 8-Week Bill Auction | 5.30% | ||

| 10:30 PM | US | 4-Week Bill Auction | 5.29% | ||

| 11:00 PM | US | 15-Year Mortgage Rate SEP/20 | 6.51% | ||

| 11:00 PM | US | 30-Year Mortgage Rate SEP/20 | 7.18% | ||

| Friday, 22 September 2023 | Previous | Consensus | Forecast | ||

| 12:00 AM | US | 10-Year TIPS Auction | 1.50% | ||

| 6:01 AM | GB | Gfk Consumer Confidence SEP | -25 | -27 | -28 |

| 6:30 AM | JP | Inflation Rate YoY AUG | 3.30% | 3.30% | |

| 6:30 AM | JP | Core Inflation Rate YoY AUG | 3.10% | 3.00% | 2.90% |

| 6:50 AM | JP | Foreign Bond Investment SEP/16 | ¥3631.9B | ||

| 6:50 AM | JP | Stock Investment by Foreigners SEP/16 | ¥-854.7B | ||

| 7:30 AM | JP | Jibun Bank Manufacturing PMI Flash SEP | 49.7 | 50 | |

| 10:00 AM | JP | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% |

| 1:00 PM | GB | Retail Sales MoM AUG | -1.20% | 0.50% | 0.40% |

| 1:00 PM | GB | Retail Sales YoY AUG | -3.20% | -1.20% | -1.30% |

| 2:30 PM | DE | HCOB Manufacturing PMI Flash SEP | 39.1 | 39.5 | 39.2 |

| 2:30 PM | DE | HCOB Services PMI Flash SEP | 47.3 | 47.1 | 46.9 |

| 3:30 PM | GB | S&P Global/CIPS Manufacturing PMI Flash SEP | 43 | 43 | 42.8 |

| 5:00 PM | GB | CBI Industrial Trends Orders SEP | -15 | -14 | |

| 8:45 PM | US | S&P Global Manufacturing PMI Flash SEP | 47.9 | 47.9 | 48 |

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 11 September 2023

- Cermati Invest Weekly Update 4 September 2023

- Cermati Invest Weekly Update 28 Agustus 2023

- Cermati Invest Weekly Update 21 Agustus 2023