| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IDX Composite | -1.49% | 7,350.62 |

| IDX LQ45 | -0.86% | 986.26 |

| IDX 30 | 0.51% | 501.72 |

| MSCI Indonesia | 0.92% | 7,642.78 |

| FTSE Indonesia | 0.91% | 3,724.97 |

| USD/IDR | 0.23% | 15,515.00 |

Provided by AIT, last update 12 Januari 2024

Market Review

Pekan lalu dari sisi domestik terdapat laporan beberapa data ekonomi penting yang menjadi perhatian investor, dan dari sisi global Amerika Serikat melaporkan tingkat inflasinya serta dampaknya terhadap kebijakan bank sentral. Sementara dari China kembali masih mencatatkan deflasi yang mulai membaik.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 0.18% | 2,049.18 |

| Crude Oil WTI | -1.42% | 72.76 |

| Palm Oil c3 F | 4.73% | 3,856 |

| Natural Gas | 15.14% | 3.33 |

| Newcastle Coal | 2.24% | 134.50 |

| Nickel | -0.38% | 16,310 |

| Tin | -0.28% | 24,554 |

| Copper | -1.93% | 8,300 |

| Aluminium | -2.40% | 2,219 |

| US Soybeans | -1.88% | 1,226.25 |

| Silver | 0.19% | 23.36 |

Provided by AIT, last update 12 Januari 2024

Economic Data

Pasar saham di Bursa Efek Indonesia (BEI) bergairah pada pekan lalu. Investor asing mencatatkan aksi beli sehingga membukukan net buy yang besar. Berdasarkan data perdagangan Bursa Efek Indonesia (BEI) selama periode 8-12 Januari 2024, rata-rata nilai transaksi harian naik 17.2% menjadi Rp9,78 triliun dari Rp8,34 triliun pada pekan lalu. Pada perdagangan Jumat (12/1/2024), investor asing mencatatkan transaksi beli bersih (net buy) sebesar Rp1,12 miliar. Dengan demikian, net buy investor asing sepanjang 2024 menjadi Rp6,07 triliun.

Pada pekan lalu, Bank Indonesia (BI) mencatat kenaikan cadangan devisa (cadev) Indonesia pada akhir 2023. Cadev per Desember 2023 sebesar US$146,4 miliar, naik sekitar 6.01% dari bulan sebelumnya US$138,1 miliar. Perolehan cadev per akhir Desember 2023 itu pun menjadi yang tertinggi sejak September 2021. Pada saat itu, BI mencatat cadev sebesar US$146,9 miliar. Sentimen lain datang dari data Indeks Penjualan Rill (IPR) Desember 2023 pada Rabu (10/1/2023) yang berada pada 217,9 atau tumbuh 0.1% yoy. Realisasi tersebut meninggalkan posisi November 2023 di 207,9 yang didorong dari meningkatnya pertumbuhan penjualan bahan bakar kendaraan bermotor serta makanan, minuman, dan tembakau.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 0.34% | 37,592.98 |

| S&P 500 | 1.84% | 4,783.83 |

| FTSE 100 | -0.84% | 7,624.93 |

| DAX | 0.66% | 16,704.56 |

| Nikkei 225 | 6.59% | 35,577.11 |

| Hang Seng | -2.02% | 16,200.50 |

| Shanghai | -1.61% | 2,881.98 |

| KOSPI | -2.06% | 2,525.05 |

Provided by AIT, last update 12 Januari 2024

Regional Info

Investor kembali menimbang dampak dari naiknya kembali inflasi konsumen (consumer price index/CPI) Amerika Serikat (AS) periode Desember 2023. Inflasi AS pada akhir 2023 naik menjadi 3.4% secara tahunan (year-on-year/yoy), dari sebelumnya sebesar 3.1% pada November 2023. Sedangkan secara bulanan (month-to-month/mtm), CPI Negeri AS pada Desember 2023 juga naik menjadi 0.3%, dari sebelumnya sebesar 0.1% pada November 2023. Angka ini tentunya lebih tinggi dari konsensus pasar dalam Trading Economics yang memperkirakan CPI AS pada Desember 2023 naik 3.2% (yoy) dan 0.2% (mtm). Selain itu data inflasi produsen (producer price index/PPI) periode Desember 2023 menunjukkan bahwa PPI Negeri Paman Sam pada akhir 2023 juga naik menjadi 1% (yoy), dari sebelumnya pada November 2023 sebesar 0.8%. Angka inflasi terbaru AS kemungkinan akan membuat bank sentral AS (Federal Reserve/The Fed) lebih berhati-hati dalam menyatakan kemenangan dalam perjuangan melawan inflasi, karena hingga saat ini inflasi AS masih belum mendekati target yang ditetapkan di 2%. Pada bulan lalu, The Fed menyatakan kemungkinan telah selesai menaikkan suku bunga, sehingga memicu perdebatan mengenai kapan mereka akan mulai menurunkan suku bunga acuannya. Ekspektasi pasar terkait The Fed yang akan mulai menurunkan suku bunga pada Maret mendatang kembali naik, meski masih lebih rendah dari perkiraan pasar pekan lalu.

Dari China, deflasinya pada Desember 2023 memang sudah mulai membaik yakni hanya deflasi 0.3% secara tahunan (year-on-year/yoy), dari sebelumnya yang deflasi 0.5% pada November 2023. Namun, China masih mengalami deflasi hingga akhir 2023. Hal ini juga menyebabkan prospek perdagangan ekspor-impor terganggu. Untuk impor China pada Desember 2023 yang akan rilis pada hari ini juga diperkirakan masih akan terkontraksi sebesar -0.5%.

Insight 2024 1st Quarter, 3rd week

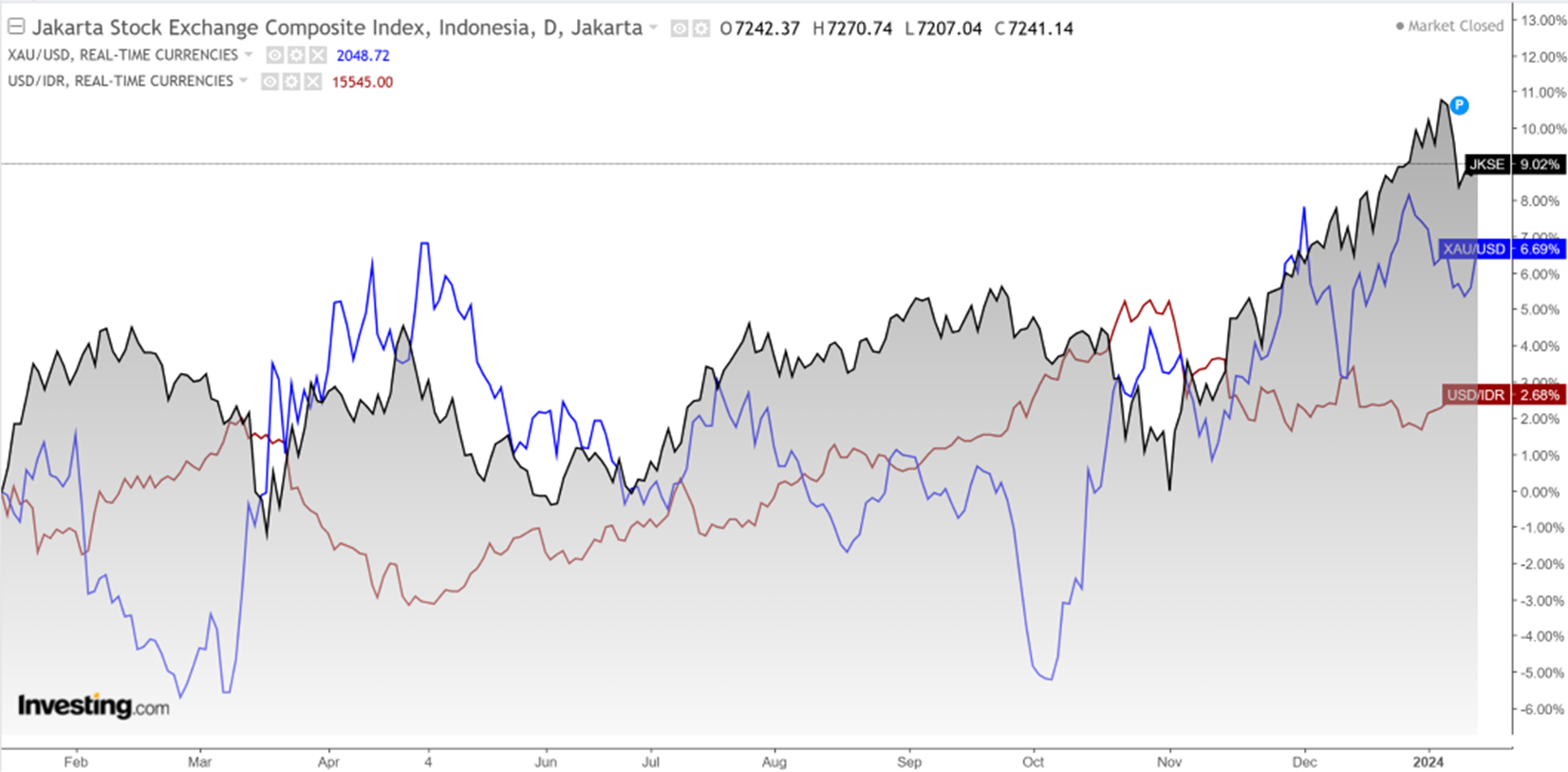

IHSG, Januari 2024, 2 pekan sudah berlalu, pekan pertama sempat mencatatkan angka tertinggi sepanjang sejarah IHSG, yaitu 7403.58, pekan selanjutnya terkoreksi ke 7152.89. Sejak awal November 2023, IHSG posisinya Uptrend, Strong Bullish.

Januari 2024 ini, selama IHSG tidak di bawah 7219,2 (Support) seharusnya aman menuju 7453 (Resistance).

RUPIAH, kurs tengah terhadap 1 dollar Amerika, masih di kisaran 15372—15606, tidak ke mana-mana.

EMAS, awal pekan ke 3 ini menuju 2062 US dollar sebagai resistance terdekat, supportnya di kisaran 2025 US dollar per troy ounce. Harga emas digital cenderung sideways di kisaran 992478—1035305 rupiah per gram, tetapi nantinya stabil di atas 1030567.

CERMATI, reksa dana yang kembali bergerak naik, pekan ini, beberapa yang dapat dicermati adalah jenis pendapatan tetap atau fixed income, seperti, UOBam Inovasi Obligasi Nasional, Sequis Bond Optima, HPam Government Bond, Eastspring Idr Fixed Income Fund Kelas A, Eastspring Investments Idr High Grade kelas A, Danareksa Melati Pendapatan Utama, Danareksa Brawijaya Abadi Pendapatan Tetap, Cipta Bond, BNI-Am Pendapatan Tetap Quality Long Duration Fund, BNI-Am Dana Pendapatan Tetap Syariah Ardhani, Batavia Dana Obligasi Ultima, Bahana Primavera Plus.

Untuk USD, dapat Cermati reksa dana Eastspring Syariah Equity Islamic Asia Pasific.

COMPOSITE INDEX compare to USDIDR & GOLD (Daily Performance) since 2023

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Sam Mutiara Nusantara Nusa Campuran | 1850.09 | 4.92% | -0.84% | -0.55% | 1.01% | 8.41% | 1.43% | 85.01% | 21 Dec 2017 | 30.48 B |

| Setiabudi Dana Campuran | 1366.89 | 3.78% | -0.57% | 1.36% | 0.97% | 10.41% | 30.40% | 36.69% | 25 Sep 2017 | 59.74 B |

| Trim Syariah Berimbang | 3070.47 | 3.20% | -1.80% | -1.46% | 0.83% | 4.26% | -2.70% | 207.05% | 27 Dec 2006 | 19.02 B |

| Batavia Dana Dinamis | 9458.45 | 3.09% | 2.20% | 0.81% | 0.72% | 7.45% | 10.07% | 845.85% | 3 Jun 2002 | 178.55 B |

| Syailendra Balanced Opportunity Fund | 3116.88 | 2.58% | -1.56% | -0.21% | 0.94% | 1.52% | 13.75% | 211.69% | 22 Apr 2008 | 86.92 B |

| Trim Kombinasi 2 | 2695.46 | 2.39% | -0.55% | 2.01% | 1.53% | 8.86% | 7.93% | 169.55% | 10 Nov 2006 | 24.36 B |

| Trimegah Balanced Absolute Strategy Kelas A | 1743.42 | 2.22% | -1.02% | 2.01% | 1.45% | 9.88% | 22.62% | 74.34% | 28 Dec 2018 | 282.79 B |

| Investasi Fleksibel"}">Danakita Investasi Fleksibel | 1450.42 | 2.13% | 2.19% | 2.63% | 0.65% | 5.83% | 13.39% | 45.04% | 8 Jun 2017 | 10.29 B |

| Hpam Flexi Plus | 1661.79 | -2.95% | 4.95% | 10.19% | -5.04% | 4.42% | -10.09% | 66.18% | 2 Mar 2011 | 41.91 B |

Provided by AIT, last update 12 Januari 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Cipta Dana Cash | 1622.10 | 0.53% | 1.38% | 2.45% | 0.18% | 4.79% | 13.56% | 62.21% | 8 Jun 2015 | 177.25 B |

| Danareksa Seruni Pasar Uang Syariah | 1265.08 | 0.50% | 1.49% | 2.55% | 0.18% | 4.76% | 11.68% | 26.51% | 19 Jul 2018 | 36.19 B |

| Principal Cash Fund Syariah 2 | 1080.36 | 0.46% | 1.10% | 1.82% | 0.15% | 3.81% | - | 8.04% | 1 Dec 2020 | 11.85 B |

| Uobam Esg Pasar Uang Indonesia | 1089.07 | 0.46% | 1.05% | 1.83% | 0.18% | 3.62% | 8.00% | 8.91% | 9 Oct 2020 | 117.85 B |

| Setiabudi Dana Pasar Uang | 1428.84 | 0.45% | 1.29% | 2.52% | 0.15% | 4.78% | 12.91% | 42.88% | 23 Dec 2016 | 759.48 B |

| Trimegah Kas Syariah | 1356.24 | 0.44% | 1.22% | 2.30% | 0.14% | 4.43% | 11.86% | 35.62% | 30 Dec 2016 | 675.44 B |

| Bahana Likuid Syariah Kelas G | 1146.35 | 0.44% | 1.14% | 2.18% | 0.18% | 4.21% | 10.42% | 14.64% | 12 Jul 2016 | 227.60 B |

| Principal Cash Fund | 1780.16 | 0.44% | 0.97% | 1.80% | 0.20% | 3.92% | 10.14% | 78.02% | 23 Dec 2011 | 133.88 B |

| Bni-Am Dana Lancar Syariah | 1704.88 | 0.43% | 0.98% | 1.88% | 0.13% | 3.95% | 10.38% | 70.49% | 28 Jun 2013 | 129.51 B |

| Eastspring Syariah Money Market Khazanah Kelas A | 1133.72 | 0.43% | 0.98% | 1.76% | 0.19% | 3.10% | 5.31% | 13.37% | 20 Dec 2018 | 6.34 B |

| Syailendra Dana Kas | 1605.88 | 0.42% | 1.12% | 2.13% | 0.13% | 4.22% | 12.59% | 60.59% | 12 Jun 2015 | 2.86 T |

| Eastspring Investment Cash Reserve Kelas A | 1619.04 | 0.42% | 1.10% | 1.75% | 0.15% | 3.47% | 6.79% | 61.90% | 3 Jul 2013 | 52.51 B |

Provided by AIT, last update 12 Januari 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Syailendra Fixed Income Fund | 2513.27 | 1.16% | 2.66% | 0.62% | -0.07% | 5.35% | 11.63% | 151.33% | 8 Dec 2011 | 177.17 B |

| Hpam Government Bond | 1544.63 | 1.13% | 2.26% | 0.67% | -0.19% | 5.34% | 11.95% | 54.46% | 18 May 2016 | 21.29 B |

| Bni-Am Short Duration Bonds Index Kelas R1 | 1048.10 | 0.93% | 1.83% | 0.70% | 0.00% | 4.80% | - | 4.81% | 1 Sep 2022 | 3.48 B |

| Bni-Am Pendapatan Tetap Quality Long Duration Fund | 1618.79 | 0.92% | 2.33% | 0.24% | -0.23% | 5.70% | 13.03% | 61.88% | 16 Jun 2016 | 20.18 B |

| Eastspring Idr Fixed Income Fund Kelas A | 1689.65 | 0.91% | 2.44% | 0.04% | -0.16% | 4.48% | 11.76% | 68.97% | 16 Mar 2015 | 133.68 B |

| Cipta Bond | 1747.26 | 0.89% | 2.13% | 1.25% | -0.26% | 4.14% | 8.01% | 74.73% | 2 Jan 2019 | 17.96 B |

| Danareksa Brawijaya Abadi Pendapatan Tetap | 1328.70 | 0.88% | 2.43% | -0.49% | -0.19% | 3.42% | 10.74% | 32.87% | 25 Feb 2019 | 11.22 B |

| Danakita Obligasi Negara | 1076.76 | 0.87% | 2.06% | 0.71% | -0.08% | 3.68% | - | 7.68% | 26 Mar 2021 | 54.27 B |

| Batavia Dana Obligasi Ultima | 2901.75 | 0.87% | 1.82% | 0.78% | 0.11% | 4.18% | 9.78% | 190.18% | 20 Dec 2006 | 1.34 T |

| Danareksa Melati Pendapatan Utama | 1821.45 | 0.68% | 2.38% | -0.91% | -0.36% | 4.05% | 8.45% | 82.14% | 27 Sep 2012 | 46.16 B |

| Insight Haji Syariah | 4718.04 | 0.51% | 1.35% | 2.86% | 0.17% | 6.63% | 22.34% | 371.80% | 13 Jan 2005 | 1.60 T |

| Uobam Inovasi Obligasi Nasional | 987.03 | 0.50% | 4.27% | 4.27% | -0.33% | 3.35% | - | -1.30% | 12 Jan 2021 | 82.99 B |

Provided by AIT, last update 12 Januari 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Trimegah Ftse Indonesia Low Volatility Factor Index | 1313.84 | 7.04% | 3.83% | 2.01% | 1.86% | 15.35% | - | 31.38% | 3 Nov 2020 | 27.15 B |

| Bni-Am Indeks Idx Growth30 Kelas R1 | 1210.93 | 6.69% | 3.60% | 5.18% | 2.17% | 13.26% | - | 21.09% | 27 Jan 2022 | 1.84 B |

| Insight Sri Kehati Likuid - I Sri Likuid | 1233.30 | 6.31% | 1.96% | 1.58% | 2.11% | 15.79% | 18.12% | 23.33% | 29 Mar 2018 | 50.91 B |

| Danareksa Msci Indonesia Esg Screened Kelas A | 1107.62 | 6.14% | 3.63% | 2.20% | 1.64% | 12.59% | - | 10.76% | 7 Sep 2022 | 126.57 B |

| Bahana Primavera 99 Kelas G | 1340.98 | 5.52% | 1.87% | 2.03% | 1.79% | 8.07% | 5.06% | 34.10% | 5 Sep 2014 | 25.93 B |

| Syailendra Msci Indonesia Value Index Fund Kelas A | 1201.68 | 5.21% | 2.43% | 1.96% | 1.39% | 19.46% | 13.30% | 20.17% | 8 Jun 2018 | 769.23 B |

| Uobam Indeks Bisnis-27 | 1456.61 | 4.93% | 1.70% | 1.17% | 1.09% | 10.35% | 16.94% | 45.66% | 15 Aug 2012 | 6.49 B |

| Cipta Rencana Cerdas | 18148.78 | 4.86% | 0.50% | -2.44% | 2.00% | 8.43% | 14.86% | 1714.88% | 9 Jul 1999 | 105.85 B |

| Bni-Am Indeks Idx30 | 868.31 | 4.76% | 3.38% | 1.07% | 1.11% | 10.49% | -0.14% | -13.17% | 28 Dec 2017 | 1.63 T |

| Principal Index Idx30 Kelas O | 1377.33 | 4.74% | 3.49% | 1.19% | 1.10% | 10.59% | -2.09% | 37.73% | 7 Dec 2012 | 67.87 B |

| Cipta Saham Unggulan Syariah | 2392.00 | 4.40% | -4.87% | -10.28% | 2.16% | 5.41% | 3.73% | 139.20% | 5 Sep 2018 | 22.13 B |

| Cipta Saham Unggulan | 2981.74 | 4.14% | -1.01% | -5.16% | 1.75% | 11.08% | 19.65% | 198.17% | 4 Dec 2018 | 59.73 B |

| Syailendra Equity Opportunity Fund | 4148.06 | 3.88% | 0.25% | 0.61% | 1.01% | 11.08% | 2.24% | 314.81% | 7 Jun 2007 | 338.07 B |

| Eastspring Investments Alpha Navigator Kelas A | 1557.16 | 3.77% | -1.41% | -0.61% | 0.77% | 8.10% | 10.53% | 55.72% | 29 Aug 2012 | 90.51 B |

| Batavia Dana Saham | 64651.37 | 3.68% | 1.91% | 0.63% | 0.91% | 8.09% | 4.67% | 6365.14% | 16 Dec 1996 | 2.05 T |

| Sam Indonesian Equity Fund | 2358.38 | 3.67% | 2.77% | 11.40% | 1.54% | 19.95% | 14.85% | 135.84% | 18 Oct 2011 | 1.06 T |

| Batavia Disruptive Equity | 1083.12 | 3.37% | 3.91% | 3.09% | 0.89% | 13.68% | - | 8.31% | 15 Dec 2021 | 31.91 B |

| Batavia Dana Saham Optimal | 3272.50 | 3.14% | 1.49% | -0.18% | 0.73% | 8.19% | 9.77% | 227.25% | 19 Oct 2006 | 506.81 B |

| Trim Kapital Plus | 4417.95 | 2.80% | 0.31% | 1.58% | 0.19% | 16.84% | 24.71% | 341.80% | 18 Apr 2008 | 280.21 B |

| Trim Kapital | 12038.56 | 2.17% | -1.39% | -1.45% | 0.00% | 12.88% | 20.14% | 1103.86% | 19 Mar 1997 | 362.59 B |

| Eastspring Idx Esg Leaders Plus Kelas A | 987.90 | 1.04% | 4.88% | 1.26% | -3.38% | 7.83% | - | -1.21% | 12 Jan 2022 | 18.90 B |

| Hpam Ekuitas Syariah Berkah | 1591.04 | 0.68% | 12.60% | 20.45% | -3.21% | 18.88% | 51.78% | 59.10% | 20 Jan 2020 | 1.67 T |

Provided by AIT, last update 12 Januari 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Eastspring Syariah Equity Islamic Asia Pacific Usd Kelas A | 0.9292 | 0.99% | 1.91% | -3.29% | -2.30% | -9.53% | -35.81% | -7.08% | 28 Oct 2016 | 5.04 M |

| Eastspring Syariah Greater China Equity Usd Kelas A | 0.5895 | -1.52% | -4.13% | -9.77% | -2.63% | -23.05% | -53.47% | -41.05% | 15 Jun 2020 | 6.79 M |

| Eastspring Syariah Fixed Income Usd Kelas A | 0.9537 | 1.41% | 3.54% | 3.70% | -0.18% | 3.73% | - | -4.63% | 8 Mar 2021 | 1.15 M |

Provided by AIT, last update 12 Januari 2024

Event Calendar

| Monday, 15 January 2024 | Previous | Consensus | Forecast | ||

| 11:00 AM | ID | Balance of Trade DEC | $2.41B | $1.92B | $ 3.0B |

| 2:00 PM | DE | Wholesale Prices MoM DEC | -0.20% | -0.30% | |

| 2:00 PM | DE | Wholesale Prices YoY DEC | -3.60% | -2.30% | |

| 4:00 PM | DE | Full Year GDP Growth 2023 | 1.90% | -0.30% | -0.30% |

| Tuesday, 16 January 2024 | Previous | Consensus | Forecast | ||

| 2:00 PM | DE | Inflation Rate MoM Final DEC | -0.40% | 0.10% | 0.10% |

| 2:00 PM | DE | Inflation Rate YoY Final DEC | 3.20% | 3.70% | 3.70% |

| 2:00 PM | GB | Unemployment Rate NOV | 4.20% | 4.30% | 4.30% |

| 2:00 PM | GB | Average Earnings incl. Bonus (3Mo/Yr) NOV | 7.20% | 6.80% | 7.00% |

| 2:00 PM | GB | Employment Change OCT | 50K | 80.0K | |

| 5:00 PM | DE | ZEW Economic Sentiment Index JAN | 12.80 | 12.70 | 15.00 |

| 8:30 PM | US | NY Empire State Manufacturing Index JAN | -14.50 | -5.00 | -9.00 |

| Wednesday, 17 January 2024 | Previous | Consensus | Forecast | ||

| 6:00 AM | JP | Reuters Tankan Index JAN | 12 | 11 | |

| 8:30 AM | CN | House Price Index YoY DEC | -0.20% | -0.40% | |

| 9:00 AM | CN | GDP Growth Rate YoY Q4 | 4.90% | 5.30% | |

| 9:00 AM | CN | Industrial Production YoY DEC | 6.60% | 6.30% | |

| 9:00 AM | CN | Fixed Asset Investment (YTD) YoY DEC | 2.90% | 3.00% | |

| 9:00 AM | CN | GDP Growth Rate QoQ Q4 | 1.30% | 1.20% | |

| 9:00 AM | CN | Retail Sales YoY DEC | 10.10% | 11.00% | |

| 9:00 AM | CN | Unemployment Rate DEC | 5.00% | 5.00% | |

| 2:00 PM | GB | Inflation Rate YoY DEC | 3.90% | 3.80% | 3.70% |

| 2:00 PM | GB | Core Inflation Rate YoY DEC | 5.10% | 4.90% | 4.80% |

| 2:00 PM | GB | Inflation Rate MoM DEC | -0.20% | 0.20% | 0.10% |

| 2:30 PM | ID | Interest Rate Decision | 6.00% | 6.00% | 6.00% |

| 8:30 PM | US | Retail Sales MoM DEC | 0.30% | 0.40% | 0.30% |

| 8:30 PM | US | Export Prices MoM DEC | -0.90% | -0.60% | -0.50% |

| 8:30 PM | US | Import Prices MoM DEC | -0.40% | -0.50% | -0.60% |

| 8:30 PM | US | Retail Sales Ex Autos MoM DEC | 0.20% | 0.20% | 0.20% |

| 9:15 PM | US | Industrial Production MoM DEC | 0.20% | 0.00% | -0.10% |

| 10:00 PM | US | Business Inventories MoM NOV | -0.10% | -0.10% | -0.10% |

| 10:00 PM | US | NAHB Housing Market Index JAN | 37 | 39 | 38 |

| Thursday, 18 January 2024 | Previous | Consensus | Forecast | ||

| 4:30 AM | US | API Crude Oil Stock Change JAN/12 | -5.215M | ||

| 6:50 AM | JP | Machinery Orders MoM NOV | 0.70% | -0.80% | -0.50% |

| 6:50 AM | JP | Machinery Orders YoY NOV | -2.20% | 0.20% | 0.40% |

| 8:30 PM | US | Building Permits Prel DEC | 1.467M | 1.475M | 1.48M |

| 8:30 PM | US | Building Permits MoM Prel DEC | -2.10% | 0.90% | |

| 8:30 PM | US | Housing Starts DEC | 1.56M | 1.439M | 1.43M |

| 8:30 PM | US | Housing Starts MoM DEC | 14.80% | -8.30% | |

| 8:30 PM | US | Initial Jobless Claims JAN/13 | 202K | 207K | 205.0K |

| 8:30 PM | US | Philadelphia Fed Manufacturing Index JAN | -10.50 | -8.00 | -5.00 |

| 11:00 PM | US | EIA Crude Oil Stocks Change JAN/12 | 1.338M | ||

| 11:00 PM | US | EIA Gasoline Stocks Change JAN/12 | 8.029M | ||

| CN | FDI (YTD) YoY DEC | -10.00% | -11.00% | ||

| Friday, 19 January 2024 | Previous | Consensus | Forecast | ||

| 6:30 AM | JP | Inflation Rate YoY DEC | 2.80% | 2.60% | |

| 6:30 AM | JP | Core Inflation Rate YoY DEC | 2.50% | 2.30% | 2.30% |

| 2:00 PM | DE | PPI MoM DEC | -0.50% | -0.50% | -0.30% |

| 2:00 PM | GB | Retail Sales MoM DEC | 1.30% | -0.50% | -0.30% |

| 2:00 PM | GB | Retail Sales ex Fuel MoM DEC | 1.30% | -0.60% | -0.30% |

| 2:00 PM | GB | Retail Sales YoY DEC | 0.10% | 1.10% | 1.50% |

| 10:00 PM | US | Michigan Consumer Sentiment Prel JAN | 69.7 | 69.6 | 69.0 |

| 10:00 PM | US | Existing Home Sales DEC | 3.82M | 3.82M | 3.83M |

| 10:00 PM | US | Existing Home Sales MoM DEC | 0.80% | 0.30% | |

| Sunday, 21 January 2024 | Previous | Consensus | Forecast | ||

| 4:00 AM | US | Net Long-term TIC Flows NOV | $3.3B | ||

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 8 Januari 2024

- Cermati Invest Weekly Update 2 Januari 2024

- Cermati Invest Weekly Update 27 Desember 2023

- Cermati Invest Weekly Update 18 Desember 2023