| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IDX Composite | 0.49% | 7,016.84 |

| IDX LQ45 | 0.72% | 968.15 |

| IDX 30 | 0.54% | 500.62 |

| MSCI Indonesia | 0.80% | 7,593.36 |

| FTSE Indonesia | 0.67% | 3,702.11 |

| USD/IDR | 0.05% | 15,358.00 |

Provided by AIT, last update 22 September 2023

Market Review

Volume transaksi harian bursa kembali menurun, suku bunga Bank Indonesia kembali dipertahankan sesuai dengan ekspektasi pasar. Dari pasar global, investor masih memperhatikan arah kebijakan moneter dari bank sentral Amerika Serikat.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 0.10% | 1,925.46 |

| Crude Oil WTI | -0.48% | 90.33 |

| Palm Oil c3 F | -2.75% | 3,681 |

| Natural Gas | 0.19% | 2.65 |

| Newcastle Coal | 0.00% | 160.50 |

| Nickel | -2.60% | 19,407 |

| Tin | -0.35% | 25,613 |

| Copper | -2.36% | 8,207 |

| Aluminium | 2.65% | 2,248 |

| US Soybeans | -3.36% | 1,295.25 |

| Silver | 1.86% | 23.82 |

Provided by AIT, last update 22 September 2023

Economic Data

Selama pekan lalu.penurunan terjadi pada rata-rata volume transaksi harian Bursa, yaitu sebesar 40,79 persen menjadi 17,28 miliar lembar saham dari 29,18 miliar lembar saham pada sepekan yang lalu. Rata-rata frekuensi transaksi harian Bursa turut mengalami penurunan sebesar 2,07 persen menjadi 1.158.472 kali transaksi dari 1.182.973 kali transaksi pada pekan yang lalu. Namun kapitalisasi pasar di BEI tercatat sebesar Rp10.390 triliun, atau menanjak 0,50 persen dari penutupan pekan lalu Rp10.339 triliun.

Pada pekan lalu pasar merespons baik dari sikap Bank Indonesia (BI) yang kembali menahan suku bunga acuannya. BI 7-day Reverse Repo Rate (BI7DRR) di level 5,75%. Demikian juga suku bunga deposit facility di level 5% dan lending facility 6,5%. Gubernur BI, Perry Warjiyo menjelaskan, keputusan ini merupakan bentuk konsistensi kebijakan moneter BI untuk memastikan inflasi tetap rendah dan terkendali dalam kisaran sasaran 3% plus minus 1% pada 2023 dan 2,5% plus minus 1% pada 2024.

Dari dalam negeri awal pekan kita akan disuguhkan dengan data likuiditas perekonomian atau uang beredar dalam arti luas (M2) untuk Agustus 2023. Pada bulan sebelumnya, Posisi M2 pada Juli 2023 tercatat sebesar Rp8.350,5 triliun atau tumbuh 6,4% (yoy), lebih tinggi dibandingkan dengan pertumbuhan pada bulan sebelumnya sebesar 6,1% (yoy). Perkembangan tersebut terutama didorong oleh pertumbuhan uang kuasi sebesar 9,4% (yoy).

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | -1.89% | 33,963.84 |

| S&P 500 | -2.93% | 4,320.06 |

| FTSE 100 | -0.36% | 7,683.91 |

| DAX | -2.12% | 15,557.29 |

| Nikkei 225 | -3.39% | 32,397.00 |

| Hang Seng | -0.54% | 18,085.00 |

| Shanghai | 0.47% | 3,132.43 |

| KOSPI | -3.58% | 2,508.13 |

Provided by AIT, last update 22 September 2023

Regional Info

Investor masih mencerna keputusan Bank Sentral Amerika Serikat/The Fed untuk mempertahankan suku bunga acuannya namun memperbarui Ringkasan Proyeksi Ekonomi kuartalannya yang menunjukkan bahwa kebijakan moneter yang ketat akan tetap berlaku lebih lama dari yang diperkirakan. Gubernur the Fed Michelle Bowman mendukung pernyataan Federal Open Market Committee (FOMC), yang menunjukkan bahwa suku bunga harus naik lebih lanjut dan dipertahankan pada tingkat yang terbatas untuk beberapa waktu untuk menurunkan inflasi ke target 2 persen. Departemen Tenaga Kerja AS pada Kamis kemarin melaporkan klaim pengangguran mingguan turun menjadi 201.000 untuk pekan yang berakhir 16 September, jauh lebih rendah dari perkiraan para ekonom yang disurvei oleh Dow Jones sebesar 225.000. Ini menjadi volume klaim pengangguran baru terendah sejak Januari lalu.

Dari China, bank sentral (People's Bank of China/PBoC) memutuskan untuk mempertahankan suku bunga pinjaman acuannya (loan prime rate/LPR) pada pekan lalu. LPR tenor 1 tahun tetap di level 3,45%. Sedangkan LPR tenor 5 tahun juga ditahan di level 4,2%. Hal ini sesuai dengan prediksi pasar sebelumnya di mana PBoC akan menahan LPR kali ini. Selain itu, PBoC juga akan memberikan stimulus untuk mendongkrak beberapa sektor usaha, terutama sektor properti di China, mengingat sektor ini sebagai penyumbang besar Produk Domestik Bruto (PDB) China yakni mencapai 30%.

Sementara itu dari Jepang, data perdagangan pada periode Agustus menunjukkan adanya pelemahan, di mana ekspor dan impor Jepang mengalami penurunan. Ekspor Jepang pada periode Agustus 2023 turun menjadi minus 0,8% (year-on-year/yoy), dari sebelumnya pada Juli 2023 sebesar minus 0,3%. Sedangkan impor Jepang juga mengalami penurunan menjadi minus 17,8% pada bulan lalu, dari sebelumnya minus 13,6% pada bulan Juli lalu.

Insight 2023 3rd Quarter, 13th week

IHSG, pekan terakhir kuartal 3 (window dressing) perlahan melanjutkan Up Trend dalam area 6950 (support) - 7065 (resistance). Hindari Saham jika pekan ini IHSG turun ke bawah 6950 dan tidak kembali naik.

RUPIAH, kedepannya masih melemah menuju 15759, penguatan terbatas hanya sampai 15255.

EMAS, kembali menguat menuju 1947 US dollar per troy ounce, kalaupun melemah menuju 1913 US dollar per troy ounce. Harga Emas dalam rupiah di kisaran 969355 — 986984 rupiah per gram (di luar biaya-biaya). Sehingga harga emas perhiasan sekitar 739938 rupiah per gram (di luar biaya pembuatan).

CERMATI, reksa dana campuran & saham. Performa indeks terbaik sejak 2022 sampai hari ini, yaitu indeks Srikehati, Bisnis 27, FTSE Indonesia & MSCI Indonesia. Sedangkan sektor terbaik sejak awal 2023 masih Non Cyclicals, Infrastruktur & Transportasi. Sedangkan sektor energi & industri dasar sejak juni 2023 terus bergerak naik. Cermati saham-saham terbaik di sektor tersebut. Sebagai gambaran, Saham siklikal dan perusahaannya memiliki hubungan langsung dengan perekonomian, sementara saham non-siklikal berulang kali mengungguli pasar ketika pertumbuhan ekonomi melambat.

CRYPTO, pekan ini bergerak lebih tinggi untuk pairs USD, misalkan BTCUSD, ETHUSD, ADAUSD, DOTUSD, NEOUSD.

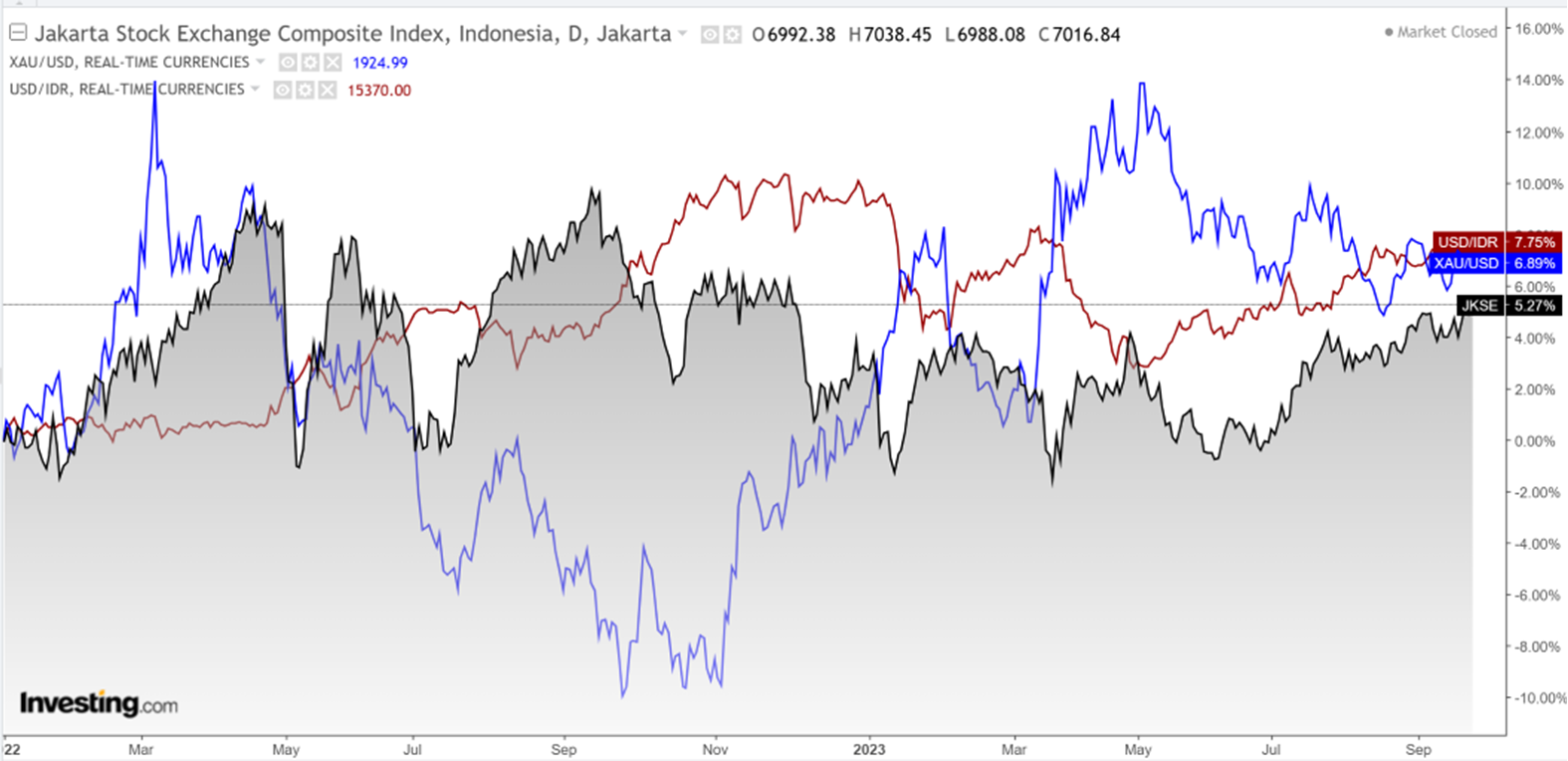

USDIDR & GOLD compare to COMPOSITE INDEX (Daily Performance) since 2022

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM (B) |

| Trimegah Balanced Absolute Strategy Kelas A | 1846.97 | 5.68% | 11.23% | 16.51% | 16.10% | 7.64% | 61.98% | 84.70% | 28 Dec 2018 | 295 |

| Sam Mutiara Nusantara Nusa Campuran | 1932.69 | 5.42% | 5.11% | 8.07% | 12.78% | 4.75% | 56.61% | 93.27% | 21 Dec 2017 | 29 |

| Trim Syariah Berimbang | 3343.76 | 5.18% | 10.48% | 14.98% | 14.42% | 5.59% | 36.02% | 234.38% | 27 Dec 2006 | 20 |

| Trim Kombinasi 2 | 2837.67 | 5.11% | 10.50% | 15.43% | 14.63% | 7.59% | 46.58% | 183.77% | 10 Nov 2006 | 24 |

| Hpam Flexi Plus | 1609.74 | 5.03% | 5.24% | 1.35% | -1.06% | -5.45% | 4.55% | 60.97% | 2 Mar 2011 | 40 |

| Syailendra Balanced Opportunity Fund | 3262.43 | 2.55% | 5.78% | 6.84% | 6.54% | -1.69% | 48.97% | 226.24% | 22 Apr 2008 | 103 |

| Setiabudi Dana Campuran | 1397.24 | 1.21% | 5.63% | 10.89% | 9.92% | 5.94% | 60.44% | 39.72% | 25 Sep 2017 | 61 |

| Sequis Balance Ultima | 1239.62 | 1.19% | 1.86% | 6.65% | 6.18% | 4.31% | 23.36% | 23.96% | 8 Sep 2016 | 139 |

| Investasi Fleksibel"}">Danakita Investasi Fleksibel | 1419.23 | 0.24% | 0.94% | 3.00% | 3.43% | 2.82% | 17.00% | 41.92% | 8 Jun 2017 | 10 |

| Batavia Dana Dinamis | 9393.50 | 0.11% | 1.22% | 6.03% | 5.77% | 3.21% | 32.56% | 839.35% | 3 Jun 2002 | 438 |

Provided by AIT, last update 22 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM (B) |

| Cipta Dana Cash | 1596.41 | 0.45% | 1.05% | 2.15% | 3.22% | 4.35% | 13.18% | 59.64% | 8 Jun 2015 | 146.5 |

| Setiabudi Dana Pasar Uang | 1406.83 | 0.41% | 1.20% | 2.36% | 3.29% | 4.30% | 12.97% | 40.68% | 23 Dec 2016 | 685.8 |

| Danakita Stabil Pasar Uang | 1515.93 | 0.37% | 1.16% | 2.29% | 3.24% | 4.25% | 13.02% | 51.59% | 10 Sep 2015 | 128.8 |

| Trimegah Kas Syariah | 1336.86 | 0.36% | 1.08% | 2.15% | 3.05% | 4.14% | 11.54% | 33.69% | 30 Dec 2016 | 377.8 |

| Trim Kas 2 Kelas A | 1780.65 | 0.36% | 1.07% | 2.14% | 3.03% | 4.10% | 12.73% | 78.06% | 8 Apr 2008 | 3741.8 |

| Hpam Ultima Money Market | 1512.06 | 0.35% | 1.04% | 2.27% | 3.27% | 4.33% | 14.42% | 51.21% | 10 Jun 2015 | 622.7 |

| Insight Retail Cash Fund | 1477.35 | 0.28% | 1.02% | 2.39% | 3.22% | 3.99% | 13.21% | 47.74% | 13 Apr 2018 | 2.7 |

| Syailendra Dana Kas | 1584.24 | 0.28% | 0.97% | 2.04% | 2.93% | 4.07% | 12.85% | 58.42% | 12 Jun 2015 | 3870.6 |

Provided by AIT, last update 22 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM (B) |

| Insight Haji Syariah | 4642.11 | 0.43% | 1.58% | 3.47% | 5.10% | 6.97% | 23.17% | 364.21% | 13 Jan 2005 | 1946.8 |

| Principal Income Fund Syariah | 1098.08 | 0.31% | -0.35% | 5.04% | 5.10% | 7.80% | - | 9.81% | 21 Oct 2020 | 3.3 |

| Bni-Am Dana Pendapatan Tetap Syariah Ardhani | 1569.86 | 0.10% | -0.21% | 4.33% | 5.65% | 6.54% | 17.64% | 56.99% | 16 Aug 2016 | 384.0 |

| Eastspring Syariah Fixed Income Amanah Kelas A | 1423.20 | 0.04% | -0.15% | 3.62% | 4.14% | 4.91% | 13.72% | 42.32% | 17 Apr 2017 | 223.6 |

| Hpam Government Bond | 1515.47 | -0.01% | -0.83% | 3.50% | 4.57% | 7.46% | 14.36% | 51.55% | 18 May 2016 | 19.6 |

| Syailendra Fixed Income Fund | 2468.46 | -0.08% | -0.82% | 2.88% | 4.42% | 7.56% | 13.89% | 146.85% | 8 Dec 2011 | 191.5 |

| Bni-Am Dana Pendapatan Tetap Nirwasita | 1591.31 | -0.09% | -0.83% | 3.59% | 5.15% | 8.13% | 18.04% | 59.13% | 16 Jun 2016 | 78.6 |

Provided by AIT, last update 22 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM (B) |

| Hpam Ultima Ekuitas 1 | 2789.01 | 10.27% | 15.23% | 15.94% | 12.77% | 3.17% | 47.67% | 178.90% | 2 Nov 2009 | 680.2 |

| Sam Indonesian Equity Fund | 2339.04 | 6.41% | 12.21% | 23.65% | 16.37% | 9.74% | 62.07% | 133.90% | 18 Oct 2011 | 1025.0 |

| Trim Syariah Saham | 2066.28 | 5.75% | 11.66% | 14.76% | 13.70% | 2.86% | 35.34% | 106.63% | 27 Dec 2006 | 94.9 |

| Bahana Primavera 99 Kelas G | 1365.38 | 2.88% | 5.51% | 9.66% | 7.75% | 1.96% | 33.11% | 36.54% | 5 Sep 2014 | 25.1 |

| Trim Kapital Plus | 4520.76 | 2.69% | 5.74% | 16.19% | 16.27% | 6.86% | 69.02% | 352.08% | 18 Apr 2008 | 213.2 |

| Trim Kapital | 12539.34 | 2.09% | 4.31% | 14.03% | 14.54% | 5.76% | 65.23% | 1153.93% | 19 Mar 1997 | 347.6 |

| Eastspring Investments Alpha Navigator Kelas A | 1618.04 | 2.07% | 5.56% | 10.79% | 9.30% | 4.95% | 45.93% | 61.80% | 29 Aug 2012 | 102.3 |

| Eastspring Investments Value Discovery Kelas A | 1386.96 | 1.33% | 4.40% | 8.55% | 5.82% | -0.51% | 43.29% | 38.70% | 29 May 2013 | 450.3 |

| Danareksa Mawar Konsumer 10 Kelas A | 1673.09 | 1.09% | 2.73% | 7.36% | 6.65% | 0.43% | 30.65% | 67.31% | 16 Feb 2011 | 295.2 |

| Syailendra Equity Opportunity Fund | 4205.22 | 1.07% | 4.43% | 12.30% | 9.73% | 3.38% | 41.00% | 320.52% | 7 Jun 2007 | 332.5 |

| Sequis Equity Maxima | 1004.29 | 1.06% | 3.65% | 7.81% | 5.26% | -0.41% | 30.23% | 0.43% | 25 Aug 2016 | 1461.1 |

| Danakita Saham Prioritas | 1198.46 | 0.93% | 3.25% | 8.86% | 8.97% | 5.91% | 39.82% | 19.85% | 17 Oct 2018 | 11.4 |

| Batavia Disruptive Equity | 1071.46 | 0.81% | 3.44% | 10.74% | 10.14% | 5.25% | - | 7.15% | 15 Dec 2021 | 34.4 |

| Syailendra Msci Indonesia Value Index Fund Kelas A | 1195.13 | 0.42% | 2.71% | 12.20% | 13.96% | 6.55% | 47.91% | 19.51% | 8 Jun 2018 | 717.8 |

| Batavia Dana Saham Optimal | 3288.64 | 0.23% | 2.22% | 8.27% | 7.00% | 1.62% | 45.03% | 228.86% | 19 Oct 2006 | 531.3 |

| Bni-Am Indeks Idx Growth30 Kelas R1 | 1170.97 | 0.15% | 4.02% | 6.67% | 6.05% | 0.48% | - | 17.10% | 27 Jan 2022 | 0.8 |

| Batavia Dana Saham | 64844.75 | 0.06% | 2.52% | 7.96% | 6.13% | 1.87% | 34.48% | 6384.48% | 16 Dec 1996 | 3011.2 |

| Uobam Indeks Bisnis-27 | 1454.94 | -0.47% | 3.02% | 7.26% | 6.87% | 3.03% | 42.46% | 45.49% | 15 Aug 2012 | 11.6 |

| Insight Sri Kehati Likuid - I Sri Likuid | 1214.73 | -0.88% | 1.48% | 8.57% | 10.05% | 6.42% | 49.97% | 21.47% | 29 Mar 2018 | 74.4 |

| Cipta Rencana Cerdas | 18372.56 | -0.97% | 1.71% | 9.00% | 7.05% | 3.30% | 50.62% | 1737.26% | 9 Jul 1999 | 109.6 |

| Trimegah Ftse Indonesia Low Volatility Factor Index | 1275.74 | -1.52% | 0.22% | 7.27% | 7.96% | 5.32% | - | 27.57% | 3 Nov 2020 | 28.0 |

| Cipta Saham Unggulan | 3044.04 | -1.83% | 1.40% | 10.63% | 9.99% | 6.19% | 85.34% | 204.40% | 4 Dec 2018 | 72.9 |

| Cipta Saham Unggulan Syariah | 2539.94 | -4.24% | 0.15% | 10.47% | 8.82% | 1.10% | 86.22% | 153.99% | 5 Sep 2018 | 25.6 |

Provided by AIT, last update 22 September 2023

Event Calendar

| Monday, 25 September 2023 | Previous | Consensus | Forecast | ||

| 3:00 PM | DE | Ifo Business Climate SEP | 85.70 | 85.20 | 84.80 |

| 5:00 PM | GB | CBI Distributive Trades SEP | -44.00 | -23.00 | |

| 7:30 PM | US | Chicago Fed National Activity Index AUG | 0.12 | 0.15 | |

| 9:30 PM | US | Dallas Fed Manufacturing Index SEP | -17.20 | -10.00 | |

| Tuesday, 26 September 2023 | Previous | Consensus | Forecast | ||

| 8:00 PM | US | S&P/Case-Shiller Home Price YoY JUL | -1.20% | -1.00% | |

| 8:00 PM | US | S&P/Case-Shiller Home Price MoM JUL | 0.90% | 0.70% | |

| 9:00 PM | US | CB Consumer Confidence SEP | 106.10 | 105.60 | 105.50 |

| 9:00 PM | US | New Home Sales MoM AUG | 4.40% | -1.70% | |

| Wednesday, 27 September 2023 | Previous | Consensus | Forecast | ||

| 1:00 PM | DE | GfK Consumer Confidence OCT | -25.50 | -25.50 | -26.20 |

| 4:30 PM | DE | 10-Year Bund Auction | 2.63% | ||

| 6:00 PM | US | MBA 30-Year Mortgage Rate SEP/22 | 7.31% | ||

| 7:30 PM | US | Durable Goods Orders MoM AUG | -5.20% | -0.40% | -1.40% |

| 7:30 PM | US | Durable Goods Orders Ex Transp MoM AUG | 0.50% | 0.20% | 0.60% |

| Thursday, 28 September 2023 | Previous | Consensus | Forecast | ||

| 7:00 PM | DE | Inflation Rate YoY Prel SEP | 6.10% | 4.60% | 4.90% |

| 7:00 PM | DE | Inflation Rate MoM Prel SEP | 0.30% | 0.40% | 0.60% |

| 7:30 PM | US | GDP Growth Rate QoQ Final Q2 | 2.00% | 2.20% | 2.10% |

| 7:30 PM | US | GDP Price Index QoQ Final Q2 | 4.10% | 2.00% | 2.00% |

| 7:30 PM | US | Initial Jobless Claims SEP/23 | 201K | 217K | 205K |

| 9:00 PM | US | Pending Home Sales MoM AUG | 0.90% | -0.20% | 0.20% |

| 9:00 PM | US | Pending Home Sales YoY AUG | -14.00% | -11.00% | |

| Friday, 29 September 2023 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Retail Sales YoY AUG | 6.80% | 6.60% | 5.80% |

| 6:50 AM | JP | Industrial Production MoM Prel AUG | -1.80% | -0.80% | -0.70% |

| 12:00 PM | JP | Housing Starts YoY AUG | -6.70% | -8.90% | -10.00% |

| 12:00 PM | JP | Consumer Confidence SEP | 36.20 | 37.00 | |

| 1:00 PM | DE | Retail Sales MoM AUG | -0.80% | 0.10% | 0.20% |

| 1:00 PM | DE | Retail Sales YoY AUG | -2.20% | -2.00% | |

| 1:00 PM | GB | GDP Growth Rate QoQ Final Q2 | 0.10% | 0.20% | 0.20% |

| 1:00 PM | GB | GDP Growth Rate YoY Final Q2 | 0.20% | 0.40% | 0.40% |

| 2:55 PM | DE | Unemployment Rate SEP | 5.70% | 5.70% | 5.70% |

| 3:30 PM | GB | Mortgage Approvals AUG | 49.444K | 46.6K | |

| 7:30 PM | US | Core PCE Price Index MoM AUG | 0.20% | 0.20% | 0.20% |

| 7:30 PM | US | Personal Spending MoM AUG | 0.80% | 0.50% | 0.60% |

| 7:30 PM | US | Personal Income MoM AUG | 0.20% | 0.40% | 0.30% |

| 7:30 PM | US | PCE Price Index MoM AUG | 0.20% | 0.50% | 0.40% |

| 7:30 PM | US | PCE Price Index YoY AUG | 3.30% | 3.50% | 3.50% |

| 8:45 PM | US | Chicago PMI SEP | 48.70 | 47.40 | 48.00 |

| 9:00 PM | US | Michigan Consumer Sentiment Final SEP | 69.50 | 67.70 | 67.70 |

| Saturday, 30 September 2023 | Previous | Consensus | Forecast | ||

| 8:30 AM | CN | NBS Manufacturing PMI SEP | 49.70 | 50.40 | |

| 8:30 AM | CN | NBS Non Manufacturing PMI SEP | 51.00 | 52.00 | |

| Sunday, 01 October 2023 | Previous | Consensus | Forecast | ||

| 8:45 AM | CN | Caixin Manufacturing PMI SEP | 51.00 | 51.20 | |

| 8:45 AM | CN | Caixin Services PMI SEP | 51.80 | 52.60 | |

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 19 September 2023

- Cermati Invest Weekly Update 11 September 2023

- Cermati Invest Weekly Update 4 September 2023

- Cermati Invest Weekly Update 28 Agustus 2023