| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IDX Composite | -1.10% | 6,939.89 |

| IDX LQ45 | -1.60% | 952.69 |

| IDX 30 | -1.45% | 493.35 |

| MSCI Indonesia | -1.81% | 7,456.24 |

| FTSE Indonesia | -1.72% | 3,638.52 |

| USD/IDR | 0.80% | 15,493.30 |

Provided by AIT, last update 29 September 2023

Market Review

IHSG ditutup menguat dua kali dan melemah dua kali sepanjang pekan lalu. Melemahnya IHSG tak bisa dilepaskan dari sentimen ekonomi global terutama Amerika Serikat (AS). Pada pekan depan dari dalam negeri akan rilis beberapa data ekonomi penting.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | -3.96% | 1,848.73 |

| Crude Oil WTI | 0.82% | 90.77 |

| Palm Oil c3 F | 2.34% | 3,767 |

| Natural Gas | 11.11% | 2.93 |

| Newcastle Coal | -1.88% | 157.00 |

| Nickel | -3.68% | 18,703 |

| Tin | -8.79% | 23,944 |

| Copper | 0.71% | 8,280 |

| Aluminium | 5.22% | 2,358 |

| US Soybeans | -1.64% | 1,275.00 |

| Silver | -6.10% | 22.39 |

Provided by AIT, last update 29 September 2023

Economic Data

Berdasarkan data perdagangan Bursa Efek Indonesia (BEI) selama periode 25-29 September 2023, rata-rata nilai transaksi harian Bursa pekan ini meningkat 7,20% menjadi Rp11,69 triliun dari Rp10,91 triliun pada pekan sebelumnya. Kapitalisasi pasar bursa pekan lalu turun 0,99% menjadi Rp10.288 triliun dari Rp10.391 triliun pada pekan sebelumnya.

Dari dalam negeri pekan ini akan ada data inflasi periode September 2023 yang akan diumumkan pada Senin (2/10/2023). Diketahui berdasarkan laporan Badan Pusat Statistik (BPS), Indonesia mengalami inflasi tahunan 3,27% (yoy) pada Agustus 2023. Inflasi dalam negeri pada Agustus 2023 masih berada dalam target Bank Indonesia (BI), yang menyasar laju inflasi berada di kisaran 3% sampai 4% sampai akhir tahun ini.

Pada Jumat (6/10/2023) Bank Indonesia (BI) akan mengumumkan cadangan devisa Indonesia periode September 2023. Diketahui posisi cadangan devisa Indonesia pada akhir Agustus 2023 tetap tinggi sebesar US$137,1 miliar, meski sedikit menurun dibandingkan dengan posisi pada akhir Juli 2023 sebesar US$137,7 miliar.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | -1.35% | 33,507.50 |

| S&P 500 | -0.74% | 4,288.05 |

| FTSE 100 | -0.99% | 7,608.08 |

| DAX | -1.10% | 15,386.58 |

| Nikkei 225 | -1.67% | 31,861.50 |

| Hang Seng | -1.30% | 17,822.00 |

| Shanghai | -0.70% | 3,110.48 |

| KOSPI | -1.72% | 2,465.07 |

Provided by AIT, last update 29 September 2023

Regional Info

Dari Amerika S&P 500 dan Nasdaq membukukan persentase penurunan bulanan terbesar tahun ini. Pekan lalu data menunjukkan indeks harga pengeluaran konsumsi pribadi (Personal Consumption Expenditures/PCE), tidak termasuk komponen pangan dan energi yang mudah berubah, meningkat 3,9% secara tahunan di bulan Agustus, pertama kalinya dalam dua tahun terakhir indeks tersebut turun di bawah 4 persen. Data PCE yang ini mengikuti prospek jangka panjang Bank Sentral Amerika/The Fed yang masih hawkish pada minggu lalu dan mengakibatkan guncangan pasar saham karena imbal hasil obligasi AS naik ke level tertinggi dalam 16 tahun terakhir. Investor juga memperhatikan keadaan di Washington. Para pemimpin Partai Republik di DPR AS gagal meloloskan rancangan undang-undang anggaran belanja jangka pendek. Sehingga memperkuat kekhawatiran bahwa anggota parlemen federal tidak akan mencapai kesepakatan tepat waktu sehingga dapat menyebabkan penutupan pemerintahan sementara di Amerika.

Pekan lalu, Jepang mengumumkan penjualan ritel pada Agustus 2023 mereka stagnan di angka 7% (year on year/yoy) sementara secara bulanan (month to month/mtm) hanya tumbuh 0,1%. Pertumbuhan lebih kecil dibandingkan pada Juli yakni 0,2%. Output sektor industri Jepang juga terkoreksi 3,8% (yoy), lebih dalam diibandingkan kontraksi 2,3% pada Juli 2023. Output lebih rendah dibadinngkan ekspektasi pasar yakni koreksi 3%. Melemahnya output industri dan penjualan ritel menandai adanya perlambatan pada ekonomi Jepang.

Insight 2023 4th Quarter, 1st week

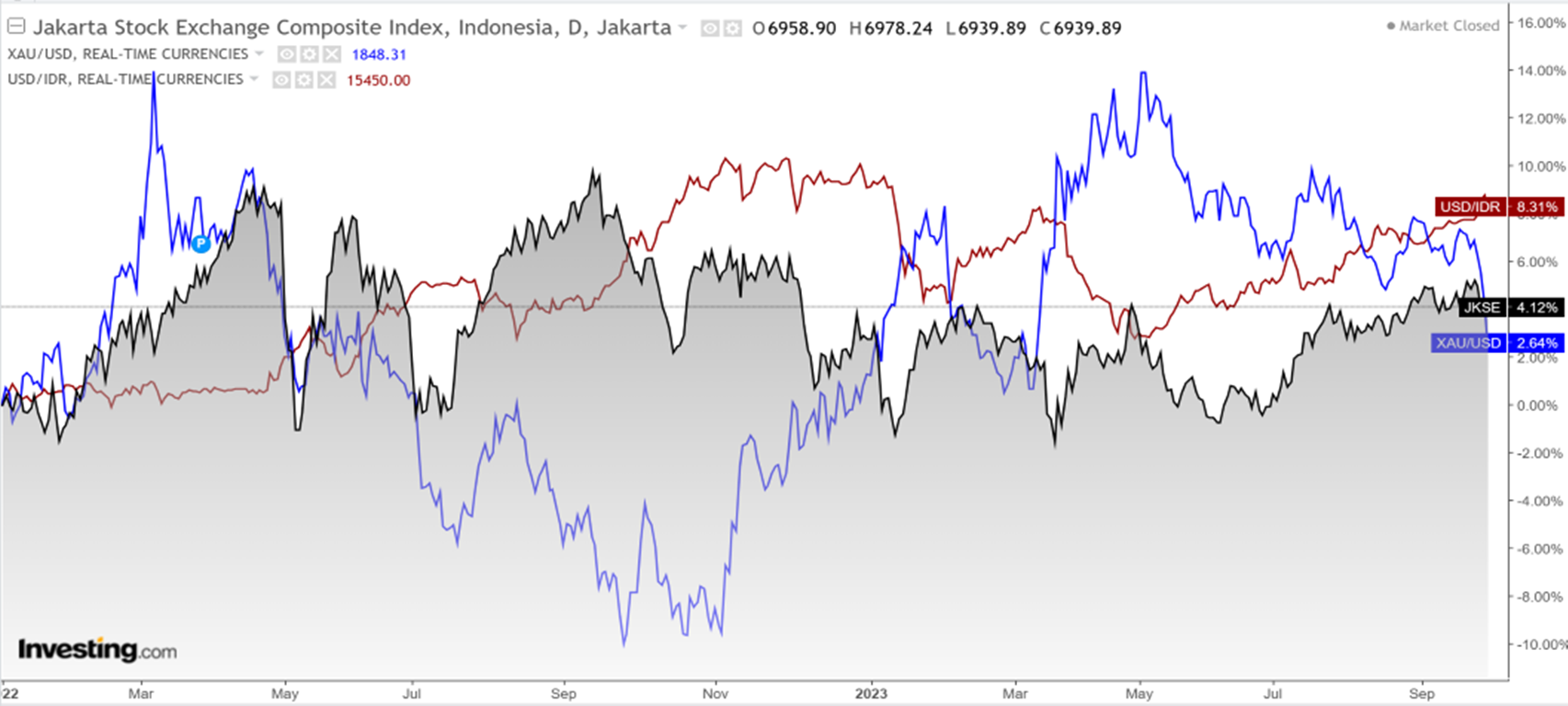

IHSG, kuartal 3 tutup di 6939.89. Harian naik tipis 0.03%, 1 Minggu -1.10%, 1 bulan –0.54% dan 1 quartal +4.17%. Kuartal 4 IHSG diprediksikan bergerak naik menuju 7377.5. Walaupun Oktober ini prediksinya membaik, tetapi pekan ini IHSG akan bergerak koreksi dalam area 6873.48 (Support) — 7078 (Resistance). Sampai akhir tahun 2023, as long as IHSG stabil di atas 6795, masih aman.

RUPIAH, terhadap 1 dolar amerika, kedepannya masih melemah menuju 15759 rupiah, penguatan terbatas sekitar 15395 rupiah.

EMAS, pekan lalu emas terkoreksi cukup dalam hampir –4%, ke posisi 1848 USD per troyounce. Pekan ini Emas dunia diperkirakan bergerak mix 1804 USD — 1888 USD per troyounce karena banyak data Amerika rilis. Pekan ini. Long term, EMAS masih potensi turun lebih dalam ke posisi 1782 USD per troyounce. Logam mulia dalam rupiah di kisaran 893009 — 956687 rupiah per gram, sehingga harga emas perhiasan sekitar 717515 rupiah per gram (diluar biaya pembuatan).

CERMATI, pekan lalu reksa dana campuran, saham & pasar uang berurutan performanya masih lebih baik dari pendapatan tetap. Setelah pekan lalu Trimegah Fixed Income Plan membagikan dividen, pekan ini NAV nya mulai bergerak naik sampai akhir Desember 2023. Sepanjang 2023, Indeks Srikehati & Bisnis27 masih terbaik, cermati saham perusahaannya.

CRYPTO, pekan ini bergerak lebih tinggi untuk pairs USD, misalkan BTCUSD, ETHUSD, ADAUSD, DOTUSD, NEOUSD.

USDIDR & GOLD compare to COMPOSITE INDEX (Daily Performance) since 2022

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM (B) |

| Sam Mutiara Nusantara Nusa Campuran | 1897.45 | 4.33% | 3.23% | 3.84% | 10.73% | 5.90% | 56.29% | 89.75% | 21 Dec 2017 | 29B |

| Trimegah Balanced Absolute Strategy Kelas A | 1810.05 | 3.54% | 9.61% | 11.21% | 13.78% | 9.67% | 59.91% | 81.01% | 28 Dec 2018 | 295B |

| Trim Kombinasi 2 | 2785.71 | 3.27% | 8.97% | 10.48% | 12.53% | 9.38% | 45.02% | 178.57% | 10 Nov 2006 | 24B |

| Trim Syariah Berimbang | 3249.24 | 1.89% | 7.49% | 8.95% | 11.19% | 6.03% | 34.22% | 224.92% | 27 Dec 2006 | 20B |

| Setiabudi Dana Campuran | 1391.42 | 1.40% | 5.28% | 7.75% | 9.47% | 7.73% | 62.22% | 39.14% | 25 Sep 2017 | 61B |

| Syailendra Balanced Opportunity Fund | 3208.42 | 1.37% | 4.06% | 4.91% | 4.77% | -1.18% | 48.40% | 220.84% | 22 Apr 2008 | 103B |

| Hpam Flexi Plus | 1569.98 | -0.24% | 3.37% | -3.46% | -3.51% | -5.83% | 2.50% | 57.00% | 2 Mar 2011 | 40B |

Provided by AIT, last update 29 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM (B) |

| Sam Dana Kas | 1358.25 | 0.48% | 1.08% | 2.14% | 3.13% | 4.02% | 10.63% | 35.82% | 10 Feb 2017 | 200.7B |

| Cipta Dana Cash | 1598.10 | 0.46% | 1.14% | 2.19% | 3.32% | 4.41% | 13.20% | 59.81% | 8 Jun 2015 | 146.5B |

| Setiabudi Dana Pasar Uang | 1408.17 | 0.41% | 1.23% | 2.36% | 3.39% | 4.35% | 12.95% | 40.82% | 23 Dec 2016 | 685.8B |

| Danakita Stabil Pasar Uang | 1517.22 | 0.38% | 1.18% | 2.28% | 3.32% | 4.35% | 13.00% | 51.72% | 10 Sep 2015 | 128.8B |

| Danareksa Seruni Pasar Uang Iii | 1649.23 | 0.38% | 1.02% | 2.05% | 2.98% | 3.84% | 11.52% | 64.92% | 16 Feb 2010 | 1442.8B |

| Hpam Ultima Money Market | 1513.30 | 0.36% | 1.07% | 2.17% | 3.35% | 4.33% | 14.36% | 51.33% | 10 Jun 2015 | 622.7B |

| Trimegah Kas Syariah | 1337.94 | 0.36% | 1.10% | 2.14% | 3.14% | 4.15% | 11.56% | 33.79% | 30 Dec 2016 | 377.8B |

| Trim Kas 2 Kelas A | 1782.12 | 0.36% | 1.09% | 2.13% | 3.12% | 4.11% | 12.72% | 78.21% | 8 Apr 2008 | 3741.8B |

| Bahana Likuid Syariah Kelas G | 1131.72 | 0.35% | 1.05% | 2.05% | 3.00% | 3.86% | 10.40% | 13.17% | 12 Jul 2016 | 176.0B |

| Sequis Liquid Prima | 1353.40 | 0.34% | 1.09% | 2.11% | 2.98% | 3.56% | 9.37% | 35.34% | 8 Sep 2016 | 40.9B |

| Batavia Dana Kas Maxima | 1697.66 | 0.33% | 1.00% | 1.95% | 2.76% | 3.41% | 9.37% | 69.77% | 20 Feb 2007 | 10730.6B |

| Syailendra Dana Kas | 1585.93 | 0.31% | 1.02% | 2.05% | 3.04% | 4.12% | 12.85% | 58.59% | 12 Jun 2015 | 3870.6B |

| Insight Retail Cash Fund | 1478.56 | 0.30% | 1.03% | 2.36% | 3.30% | 4.02% | 13.21% | 47.86% | 13 Apr 2018 | 2.7B |

Provided by AIT, last update 29 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM (B) |

| Trimegah Fixed Income Plan | 1135.83 | 0.43% | 1.39% | 3.00% | 4.63% | 7.04% | 21.34% | 13.58% | 23 May 2019 | 4891.5B |

| Insight Haji Syariah | 4646.73 | 0.42% | 1.59% | 3.40% | 5.21% | 6.95% | 23.12% | 364.67% | 13 Jan 2005 | 1946.8B |

| Principal Income Fund Syariah | 1096.34 | 0.09% | -0.71% | 4.28% | 4.94% | 8.14% | - | 9.63% | 21 Oct 2020 | 3.3B |

| Bni-Am Dana Pendapatan Tetap Syariah Ardhani | 1568.86 | -0.44% | -0.39% | 3.79% | 5.59% | 6.82% | 17.48% | 56.89% | 16 Aug 2016 | 384.0B |

| Bni-Am Dana Pendapatan Tetap Nirwasita | 1584.90 | -1.49% | -1.46% | 2.53% | 4.73% | 8.35% | 17.66% | 58.49% | 16 Jun 2016 | 78.6B |

| Syailendra Fixed Income Fund | 2449.96 | -1.63% | -1.65% | 1.53% | 3.64% | 7.40% | 13.00% | 145.00% | 8 Dec 2011 | 191.5B |

| Eastspring Idr Fixed Income Fund Kelas A | 1651.89 | -1.66% | -1.82% | 1.63% | 3.17% | 6.74% | 14.31% | 65.19% | 16 Mar 2015 | 147.4B |

| Hpam Government Bond | 1503.32 | -1.86% | -1.76% | 1.84% | 3.74% | 6.97% | 13.54% | 50.33% | 18 May 2016 | 19.6B |

Provided by AIT, last update 29 September 2023

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM (B) |

| Sam Indonesian Equity Fund | 2321.03 | 5.50% | 11.34% | 18.47% | 15.50% | 13.17% | 63.71% | 132.10% | 18 Oct 2011 | 1025.0B |

| Hpam Ultima Ekuitas 1 | 2718.61 | 3.83% | 13.21% | 10.62% | 9.92% | 5.13% | 43.92% | 171.86% | 2 Nov 2009 | 680.2B |

| Trim Syariah Saham | 1992.05 | 1.71% | 7.82% | 7.66% | 9.61% | 3.07% | 33.13% | 99.21% | 27 Dec 2006 | 94.9B |

| Trim Kapital Plus | 4458.69 | 1.39% | 4.30% | 11.04% | 14.67% | 9.42% | 69.14% | 345.87% | 18 Apr 2008 | 213.2B |

| Trim Kapital | 12361.89 | 0.83% | 2.85% | 8.98% | 12.92% | 8.05% | 65.13% | 1136.19% | 19 Mar 1997 | 347.6B |

| Bahana Primavera 99 Kelas G | 1337.86 | 0.73% | 3.04% | 3.65% | 5.58% | 2.29% | 32.43% | 33.79% | 5 Sep 2014 | 25.1B |

| Danakita Saham Prioritas | 1190.60 | 0.37% | 2.06% | 5.04% | 8.25% | 7.46% | 40.52% | 19.06% | 17 Oct 2018 | 11.4B |

| Eastspring Investments Alpha Navigator Kelas A | 1584.36 | 0.17% | 3.07% | 5.15% | 7.03% | 5.20% | 44.64% | 58.44% | 29 Aug 2012 | 102.3B |

| Syailendra Equity Opportunity Fund | 4135.27 | -0.76% | 2.41% | 6.82% | 7.91% | 3.64% | 40.87% | 313.53% | 7 Jun 2007 | 332.5B |

| Batavia Disruptive Equity | 1052.18 | -1.01% | 1.36% | 5.25% | 8.16% | 5.62% | - | 5.22% | 15 Dec 2021 | 34.4B |

| Syailendra Msci Indonesia Value Index Fund Kelas A | 1174.14 | -1.41% | 0.48% | 7.74% | 11.96% | 6.71% | 49.49% | 17.41% | 8 Jun 2018 | 717.8B |

| Insight Sri Kehati Likuid - I Sri Likuid | 1201.18 | -1.69% | -0.45% | 4.38% | 8.82% | 7.08% | 50.50% | 20.12% | 29 Mar 2018 | 74.4B |

| Cipta Saham Unggulan | 2999.00 | -3.58% | -1.06% | 6.47% | 8.36% | 8.04% | 85.84% | 199.90% | 4 Dec 2018 | 72.9B |

| Cipta Saham Unggulan Syariah | 2508.20 | -5.57% | -1.94% | 7.15% | 7.46% | 3.52% | 86.19% | 150.82% | 5 Sep 2018 | 25.6B |

Provided by AIT, last update 29 September 2023

Event Calendar

| Monday, 02 October 2023 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Tankan Large Manufacturers Index Q3 | 5.0 | 6.0 | 7.0 |

| 6:50 AM | JP | BoJ Summary of Opinions | |||

| 7:30 AM | JP | Jibun Bank Manufacturing PMI Final SEP | 49.6 | 48.6 | 48.6 |

| 11:00 AM | ID | Inflation Rate YoY SEP | 3.27% | 2.20% | 2.50% |

| 1:00 PM | GB | Nationwide Housing Prices MoM SEP | -0.80% | -0.40% | -0.30% |

| 1:00 PM | GB | Nationwide Housing Prices YoY SEP | -5.30% | -5.70% | -5.10% |

| 2:55 PM | DE | HCOB Manufacturing PMI Final SEP | 39.1 | 39.8 | 39.8 |

| 3:30 PM | GB | S&P Global/CIPS Manufacturing PMI Final SEP | 43.0 | 44.2 | 44.2 |

| 8:45 PM | US | S&P Global Manufacturing PMI Final SEP | 47.9 | 48.9 | 48.9 |

| 9:00 PM | US | ISM Manufacturing PMI SEP | 47.6 | 47.7 | 48.1 |

| 9:00 PM | US | ISM Manufacturing Employment SEP | 48.5 | 48.3 | 49 |

| 10:00 PM | US | Fed Chair Powell Speech | |||

| 10:00 PM | US | Fed Harker Speech | |||

| Tuesday, 03 October 2023 | Previous | Consensus | Forecast | ||

| 12:00 AM | US | Fed Barr Speech | |||

| 12:30 AM | US | Fed Williams Speech | |||

| 6:30 AM | US | Fed Mester Speech | |||

| 7:00 PM | US | Fed Bostic Speech | |||

| 9:00 PM | US | JOLTs Job Openings AUG | 8.827M | 8.83M | 8.6M |

| 9:00 PM | US | IBD/TIPP Economic Optimism OCT | 43.2 | 41.0 | |

| Wednesday, 04 October 2023 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change SEP/29 | 1.586M | ||

| 7:30 AM | JP | Jibun Bank Services PMI Final SEP | 54.3 | 53.3 | |

| 2:55 PM | DE | HCOB Services PMI Final SEP | 47.3 | 49.8 | 49.8 |

| 3:30 PM | GB | S&P Global/CIPS Services PMI Final SEP | 49.5 | 47.2 | 47.2 |

| 6:00 PM | US | MBA 30-Year Mortgage Rate SEP/29 | 7.41% | ||

| 7:15 PM | US | ADP Employment Change SEP | 177K | 160K | 160.0K |

| 8:45 PM | US | S&P Global Composite PMI Final SEP | 50.2 | 50.1 | |

| 8:45 PM | US | S&P Global Services PMI Final SEP | 50.5 | 50.2 | 50.2 |

| 9:00 PM | US | ISM Services PMI SEP | 54.5 | 53.6 | 53.7 |

| 9:05 PM | US | Fed Schmid Speech | |||

| 9:30 PM | US | EIA Crude Oil Stocks Change SEP/29 | -2.17M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change SEP/29 | 1.027M | ||

| 10:25 PM | US | Fed Bowman Speech | |||

| Thursday, 05 October 2023 | Previous | Consensus | Forecast | ||

| 1:00 PM | DE | Balance of Trade AUG | €15.9B | €15.8B | €16.8B |

| 1:00 PM | DE | Exports MoM AUG | -0.90% | -0.10% | |

| 3:30 PM | GB | S&P Global/CIPS Construction PMI SEP | 50.8 | 49.9 | 50.2 |

| 7:30 PM | US | Balance of Trade AUG | $-65B | $-64.6B | $-58.3B |

| 7:30 PM | US | Initial Jobless Claims SEP/30 | 204K | 210.0K | |

| 8:00 PM | US | Fed Mester Speech | |||

| 10:30 PM | US | Fed Barkin Speech | |||

| 11:00 PM | US | Fed Daly Speech | |||

| 11:15 PM | US | Fed Barr Speech | |||

| Friday, 06 October 2023 | Previous | Consensus | Forecast | ||

| 1:00 PM | DE | Factory Orders MoM AUG | -11.70% | 1.50% | 5.10% |

| 1:00 PM | GB | Halifax House Price Index MoM SEP | -1.90% | -0.20% | |

| 1:00 PM | GB | Halifax House Price Index YoY SEP | -4.60% | -5.00% | |

| 7:30 PM | US | Non Farm Payrolls SEP | 187K | 163K | 150.0K |

| 7:30 PM | US | Unemployment Rate SEP | 3.80% | 3.70% | 3.80% |

| 7:30 PM | US | Participation Rate SEP | 62.80% | 62.90% | |

| 11:00 PM | US | Fed Waller Speech | |||

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 26 September 2023

- Cermati Invest Weekly Update 19 September 2023

- Cermati Invest Weekly Update 11 September 2023

- Cermati Invest Weekly Update 4 September 2023