| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IHSG | -0.72% | 7,036.08 |

| LQ45 | -2.34% | 898.78 |

| IDX30 | -2.35% | 455.88 |

| FTSE Indonesia | -1.56% | 3,487.93 |

| MSCI Indonesia | -1.70% | 7,098.80 |

| USD/IDR | -0.05% | 16,241.50 |

Provided by Cermati Invest, last update 26 April 2024

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | -2.19% | 2,338.12 |

| Crude Oil WTI | 0.63% | 83.66 |

| Palm Oil c3 F | -0.76% | 3,896 |

| Natural Gas | 14.94% | 2.29 |

| Newcastle Coal | -0.77% | 129.60 |

| Nickel | -0.36% | 19,257 |

| Tin | -7.62% | 32,872 |

| Copper | 1.01% | 9,976 |

| Aluminium | -3.78% | 2,568 |

| US Soybeans | 0.76% | 1,159.25 |

| Silver | -5.08% | 27.38 |

Provided by Cermati Invest, last update 26 April 2024

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 0.67% | 38,239.66 |

| S&P 500 | 2.67% | 5,099.96 |

| FTSE 100 | 3.09% | 8,139.83 |

| DAX | 2.42% | 18,166.91 |

| Nikkei 225 | 2.36% | 37,943.50 |

| Hang Seng | 8.80% | 17,651.15 |

| Shanghai | 0.76% | 3,088.64 |

| KOSPI | 2.48% | 2,656.08 |

Provided by Cermati Invest, last update 26 April 2024

Ulasan Pasar

IHSG & Saham Pekan Ini

Sejak all time high 7454.44 pada pertengahan Maret 2024, sampai saat ini IHSG sudah terkoreksi (-) 427.971 poin atau (-) 5.74%. Dikatakan aman jika IHSG pada kuartal 2 ini berada di atas 7277.674 (pivot quarterly), support terdekat 6879.47.

Mayoritas indeks konstituen maupun sektoral Indonesia, performanya negatif. Sektor yang masih di zona positif hanya infrastruktur (konstruksi). Bobot terbesar market kapitalisasi sektor ini adalah emiten BREN (58.66%), sedangkan TLKM hanya 15% pengaruhnya terhadap sektor tersebut.

Beberapa saham yang dapat dicermati karena berpengaruh paling besar terhadap sektornya adalah emiten BYAN (45.37%) dari sektor energi, AMMN (34.26%) dan TPIA (31.59%) dari sektor industri dasar (bahan baku), BBCA (31.73%) dan BBRI (19.58%) dari sektor keuangan.

Pergerakan Rupiah

Pekan lalu, rupiah sedikit menguat terhadap dolar Amerika, belum mampu menguat sampai ke 15870 rupiah per 1 dolar Amerika, butuh waktu. Jika data ekonomi Amerika yang dirilis pekan ini bagus, sangat mungkin rupiah kembali tertekan. Semua tergantung kondisi Indonesia, terdekat, pelemahan rupiah bisa ke 16705 per 1 dolar Amerika.

Emas

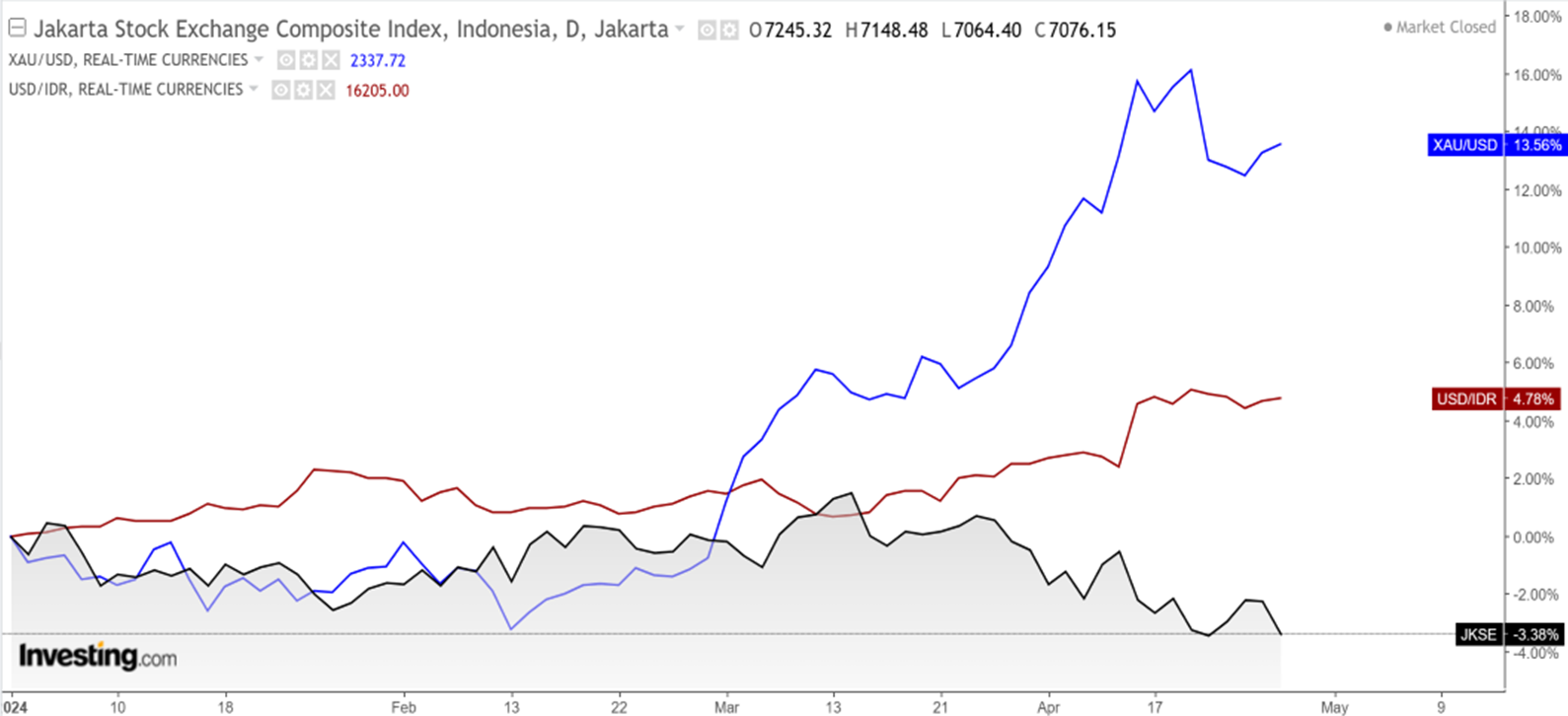

Sejak pekan lalu, harga emas dunia terkoreksi wajar. Walau terkoreksi, secara Year to Date (YtD), investasi emas jauh lebih menguntungkan dari investasi kelas aset lainnya. Jika melihat perbandingan hasil investasi antara pasar modal, nabung dolar Amerika dan beli emas, maka terlihat pasar modal yang diwakili oleh IHSG -3.38%, simpan dolar Amerika +4.78%, investasi emas +13.56%. Masih belum berubah, all time high 2431 USD (R1) per troy ounce. Keputusan suku bunga Amerika (Fed rate) pada Kamis dan Non Farm Payroll Amerika pada Jumat pekan ini, memungkinkan harga emas bergerak fluktuatif antara 2273 — 2431. Selanjutnya menuju resisten 2520 (R2) - 2859 (R3) dolar Amerika per troy ounce.

Dalam rupiah, all time high harga emas masih di sekitar 1262763 per gram. Apabila data Amerika bagus, kemungkinan dolar Amerika menguat kembali, sehingga harga emas dalam negeri berpotensi kembali naik menuju cluster 1448796 rupiah per gram.

Reksa Dana & Surat Berharga

Sejak beberapa waktu terakhir, mayoritas reksa dana kinerjanya turun tajam, terutama jenis reksa dana saham, reksa dana pendapatan tetap dan reksa dana campuran. Sehingga reksa dana sebaiknya wait and see sampai pasar saham maupun surat utang kondusif dan stabil kembali, bilamana ingin switching, reksa dana jenis pasar uang, dapat menjadi pilihan.

Suku Bunga Kembali Naik, Investor Asing Lagi-Lagi Tinggalkan Indonesia

Rapat Dewan Gubernur (RDG) Bank Indonesia pada 23-24 April 2024 memutuskan untuk menaikkan BI-Rate sebesar 25 bps menjadi 6.25%, suku bunga Deposit Facility sebesar 25 bps menjadi 5.50%, dan suku bunga Lending Facility sebesar 25 bps menjadi 7.00%. Kenaikan suku bunga ini untuk memperkuat stabilitas nilai tukar rupiah dari dampak memburuknya risiko global serta sebagai langkah pre-emptive dan forward looking untuk memastikan inflasi tetap dalam sasaran. Namun, langkah dari Bank Indonesia belum dapat menolong nilai rupiah, di mana pada penutupan pekan lalu nilai tukar rupiah masih anjlok ke Rp16.196 per US$. Pemerintah mengakui bahwa kondisi perekonomian penuh guncangan dan ketidakpastian. Penyebab utamanya adalah gejolak di global khususnya geopolitik yang memanas antara Iran dan Israel. Namun, tak hanya itu kondisi ekonomi di Amerika Serikat dan kebijakan bank sentralnya juga berpengaruh terhadap perekonomian global. Selain itu, Kementerian Keuangan (Kemenkeu) mencatat keluarnya modal asing dari Indonesia (outflow) sebesar Rp29,73 triliun pada periode bulanan yang terdiri dari saham Rp13,08 triliun dan SBN Rp16,65 triliun. Sentimen global datang dari Amerika Serikat (AS), perekonomian AS diketahui hanya tumbuh sebesar 1.6% secara tahunan pada kuartal I-2024, dibandingkan dengan 3.4% pada kuartal sebelumnya dan di bawah perkiraan sebesar 2.5%. Ini merupakan pertumbuhan terendah sejak kontraksi pada paruh pertama 2022 lalu.

COMPOSITE INDEX compare to USDIDR & GOLD (Daily Performance) since 2024

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| TRIM Kombinasi 2 | 2625.53 | -0.80% | -2.54% | 0.27% | -1.11% | 6.45% | 10.32% | 162.55% | 10 Nov 2006 | 25.45 B |

| SAM Mutiara Nusantara Nusa Campuran | 1855.5914 | -4.07% | 1.02% | 3.22% | 1.31% | 1.58% | 20.68% | 85.56% | 21 Dec 2017 | 30.81 B |

| HPAM Flexi Plus | 1750.0815 | -4.63% | 3.49% | 12.94% | 0.01% | 7.24% | 4.61% | 75.01% | 2 Mar 2011 | 42.94 B |

Provided by Cermati Invest, last update 26 April 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Bahana Dana Likuid | 1808.67 | 0.45% | 1.21% | 2.23% | 1.48% | 4.13% | 9.74% | 80.87% | 27 May 1997 | 3.36 T |

| Insight Money Syariah | 1567.3673 | 0.44% | 1.31% | 2.66% | 1.67% | 5.30% | 15.03% | 56.74% | 30 Sep 2015 | 125.50 B |

| Setiabudi Dana Pasar Uang | 1450.4937 | 0.43% | 1.31% | 2.63% | 1.67% | 5.09% | 13.07% | 45.05% | 23 Dec 2016 | 764.83 B |

| Trimegah Kas Syariah | 1376.3812 | 0.43% | 1.28% | 2.55% | 1.63% | 4.76% | 12.41% | 37.64% | 30 Dec 2016 | 1.08 T |

| Cipta Dana Cash | 1647.02 | 0.42% | 1.33% | 2.74% | 1.72% | 5.01% | 14% | 64.70% | 8 Jun 2015 | 211.75 B |

| Bahana Likuid Syariah Kelas G | 1163.29 | 0.41% | 1.24% | 2.49% | 1.66% | 4.58% | 10.88% | 16.33% | 12 Jul 2016 | 236.71 B |

| Syailendra Dana Kas | 1628.1148 | 0.40% | 1.20% | 2.40% | 1.52% | 4.51% | 12.81% | 62.81% | 12 Jun 2015 | 3.07 T |

| HPAM Ultima Money Market | 1554.3965 | 0.40% | 1.19% | 2.39% | 1.51% | 4.59% | 13.67% | 55.44% | 10 Jun 2015 | 633.72 B |

| TRIM Kas 2 Kelas A | 1829.9988 | 0.40% | 1.19% | 2.36% | 1.51% | 4.56% | 12.68% | 83.00% | 8 Apr 2008 | 3.25 T |

| BRI Seruni Pasar Uang III | 1693.1192 | 0.39% | 1.23% | 2.35% | 1.56% | 4.48% | 11.37% | 69.31% | 16 Feb 2010 | 1.25 T |

| Sequis Liquid Prima | 1388.4316 | 0.39% | 1.14% | 2.26% | 1.45% | 4.42% | 9.97% | 38.84% | 8 Sep 2016 | 122.29 B |

| Danakita Stabil Pasar Uang | 1558.21 | 0.37% | 1.18% | 2.39% | 1.50% | 4.69% | 12.77% | 55.82% | 10 Sep 2015 | 113.60 B |

| BRI Seruni Pasar Uang Syariah | 1283.3344 | 0.36% | 1.21% | 2.87% | 1.62% | 4.92% | 12.03% | 28.33% | 19 Jul 2018 | 51.90 B |

Provided by Cermati Invest, last update 26 April 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Insight Haji Syariah | 4800.8906 | 0.50% | 1.52% | 2.99% | 1.93% | 6.21% | 21.88% | 380.09% | 13 Jan 2005 | 1.32 T |

| BRI Melati Pendapatan Utama | 1805.2715 | -1.29% | -0.81% | 3.18% | -1.24% | 1.46% | 9.22% | 80.53% | 27 Sep 2012 | 47.58 B |

| HPAM Government Bond | 1526.8799 | -1.71% | -1.22% | 3.25% | -1.33% | 2.02% | 11.84% | 52.69% | 18 May 2016 | 21.59 B |

| Cipta Bond | 1728.68 | -2.18% | -1.03% | 3.07% | -1.32% | 1.29% | 8.48% | 72.87% | 2 Jan 2019 | 25.32 B |

Provided by Cermati Invest, last update 26 April 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| HPAM Ekuitas Syariah Berkah | 1775.4048 | 2.99% | 4.43% | 26.51% | 8% | 28.88% | 82.09% | 77.54% | 20 Jan 2020 | 1.40 T |

| HPAM Ultima Ekuitas 1 | 2821.3031 | -4.01% | 7.90% | 8.52% | 3.18% | 14.09% | 30.12% | 182.13% | 2 Nov 2009 | 267.99 B |

| SAM Indonesian Equity Fund | 2323.04 | -5.31% | -1.21% | 7.79% | 0.01% | 16.14% | 28.55% | 132.30% | 18 Oct 2011 | 1.09 T |

Provided by Cermati Invest, last update 26 April 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Batavia Global ESG Sharia Equity USD | 1.1275 | -2.34% | 0.48% | 9.44% | 1.01% | 8.65% | 7.34% | 12.75% | 27 Jan 2021 | 20.12 M |

| Batavia USD Bond Fund | 1.0212 | -1.10% | -1.13% | 1.47% | -1.76% | -1.58% | - | 2.12% | 18 Oct 2022 | 9.50 M |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.5974 | -2.16% | -0.17% | 2.22% | -1.32% | -12.09% | -52.42% | -40.26% | 15 Jun 2020 | 5.92 M |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 0.9485 | -2.60% | 1.89% | 7.14% | -0.27% | -3.19% | -32.45% | -5.15% | 28 Oct 2016 | 4.94 M |

| Eastspring Syariah Fixed Income USD Kelas A | 0.9352 | -1.99% | -1.49% | 1.53% | -2.11% | 0.65% | -6.38% | -6.48% | 8 Mar 2021 | 1.09 M |

Provided by Cermati Invest, last update 26 April 2024

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

|---|---|---|---|---|---|---|---|---|

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 97.77 | 96.77 | 6.46% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 99.9 | 98.9 | 6.76% | BBB |

| INKP02CCN1 | IDA0001183C1 | IDR | 10.00% | 30-Sep-26 | 100.5 | 99.5 | 9.76% | idA+ |

| LPPI02ACN1 | IDA0001331A0 | IDR | 10.50% | 4-Jul-26 | 101 | 100 | 9.98% | idA |

| SMINKP03CCN2 | IDJ0000276C5 | IDR | 11% | 25-Aug-28 | 101.75 | 100.75 | 10.24% | idA+ |

Provided by Cermati Invest, last update 26 April 2024

Event Calendar

| Monday, 29 April 2024 | Previous | Consensus | Forecast | ||

| 7:00 PM | DE | Tingkat Inflasi YoY Perkiraan Awal APR | 2.20% | 2.30% | 2.30% |

| 7:00 PM | DE | Tingkat Inflasi Perkiraan Awal MoM APR | 0.40% | 0.50% | |

| 9:30 PM | US | Dallas - Fed - Pabrik - Indeks APR | -14.40 | -11.00 | |

| Tuesday, 30 April 2024 | Previous | Consensus | Forecast | ||

| 2:00 AM | US | Treasury Refunding Financing Estimates | |||

| 6:30 AM | JP | Tingkat Pengangguran MAR | 2.60% | 2.50% | 2.40% |

| 6:50 AM | JP | Produksi Industrial Perkiraan Awal MoM MAR | -0.60% | 3.40% | 2.80% |

| 6:50 AM | JP | Penjualan Eceran YoY MAR | 4.60% | 2.20% | 2.80% |

| 8:30 AM | CN | PMI Manufaktur NBS APR | 50.8 | 50.4 | 50.7 |

| 8:30 AM | CN | PMI Non-Manufaktur NBS APR | 53 | 52.2 | 52.8 |

| 8:45 AM | CN | Indeks PMI Manufaktur Caixin APR | 51.1 | 51 | 51 |

| 12:00 PM | JP | Housing Starts (Tahunan) MAR | -8.20% | -7.40% | -7.50% |

| 1:00 PM | DE | Penjualan Eceran MoM MAR | -1.90% | 0.70% | |

| 1:00 PM | DE | Penjualan Eceran YoY MAR | -2.70% | -2.00% | |

| 2:55 PM | DE | Pengangguran APR | 2.719M | 2.740M | |

| 2:55 PM | DE | Perubahan Tingkat Pengangguran APR | 4K | 10K | 21K |

| 2:55 PM | DE | Tingkat Pengangguran APR | 5.90% | 5.90% | 5.90% |

| 3:00 PM | DE | Pertumbuhan Ekonomi QoQ Perkiraan Sekilas Q1 | -0.30% | 0.00% | 0.10% |

| 3:00 PM | DE | Pertumbuhan Ekonomi YoY Perkiraan Sekilas Q1 | -0.20% | 0.10% | |

| 3:30 PM | GB | Kredit Konsumen BoE MAR | £1.378B | £ 1.6B | |

| 3:30 PM | GB | Persetujuan Hipotek MAR | 60.383K | 59K | 59.5K |

| 3:30 PM | GB | Pinjaman Hipotek MAR | £1.51B | £1.1B | |

| 7:30 PM | US | Biaya Ketenagakerjaan - Manfaat QoQ Q1 | 0.70% | 0.70% | |

| 7:30 PM | US | Biaya Ketenagakerjaan - Upah QoQ Q1 | 0.90% | 0.90% | |

| 7:30 PM | US | Pekerjaan Biaya Indeks Qoq Q1 | 0.90% | 1.00% | 0.90% |

| 8:00 PM | US | Harga Rumah S&P/Case-Shiller MoM FEB | -0.10% | 0.60% | |

| 8:00 PM | US | Harga Rumah S&P/Case-Shiller YoY FEB | 6.60% | 6.70% | 7.00% |

| 8:45 PM | US | Indeks PMI Chicago APR | 41.4 | 45.2 | 44.0 |

| 9:00 PM | US | Indeks keyakinan Konsumen CB APR | 104.7 | 104.5 | 104.0 |

| Wednesday, 01 May 2024 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | Perubahan Stok Minyak Mentah API APR/26 | -3.23M | ||

| 7:00 AM | KR | Ekspor YoY APR | 3.10% | ||

| 7:30 AM | JP | PMI Manufaktur Jibun Bank Final APR | 48.2 | 49.9 | 49.9 |

| 3:30 PM | GB | Final IMP Manufaktur Global S&P APR | 50.3 | 48.7 | 48.7 |

| 7:15 PM | US | Perubahan Tenaga Kerja Adp APR | 184K | 180K | 162.0K |

| 7:30 PM | US | Treasury Refunding Announcement | |||

| 8:45 PM | US | Final IMP Manufaktur Global S&P APR | 51.9 | 49.9 | 49.9 |

| 9:00 PM | US | Pmi Ism Manufacturing APR | 50.3 | 50.0 | 49.9 |

| 9:00 PM | US | Lowongan Kerja JOLTs MAR | 8.756M | 8.72M | 8.7M |

| 9:00 PM | US | Ism Manufacturing Pekerjaan APR | 47.4 | 47.5 | |

| 9:30 PM | US | Perubahan Persediaan Minyak Mentah EIA APR/26 | -6.368M | ||

| 9:30 PM | US | Perubahan Persediaan Bensin EIA APR/26 | -0.634M | ||

| GB | Harga Perumahan Nationwide MoM APR | -0.20% | 0.30% | ||

| GB | Harga Perumahan Nationwide YoY APR | 1.60% | 2.50% | ||

| Thursday, 02 May 2024 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | Keputusan Tingkat Suku Bunga Fed | 5.50% | 5.50% | 5.50% |

| 1:30 AM | US | Keterangan Pers Fed | |||

| 6:00 AM | KR | Tingkat Inflasi (Tahunan) APR | 3.10% | 3.30% | |

| 6:50 AM | JP | Notulen Rapat Kebijakan Moneter BoJ | |||

| 7:30 AM | KR | PMI Manufaktur Global S&P APR | 49.8 | 49.9 | |

| 11:00 AM | ID | Tingkat Inflasi (Tahunan) APR | 3.05% | 3.40% | |

| 12:00 PM | JP | Keyakinan Konsumen APR | 39.5 | 39.5 | 39.6 |

| 1:00 PM | RU | PMI Manufaktur Global S&P APR | 55.7 | 55.3 | |

| 2:55 PM | DE | Final PMI Manufaktur HCOB APR | 41.9 | 42.2 | 42.2 |

| 3:30 PM | HK | Pertumbuhan Ekonomi QoQ Angka Sementara Q1 | 0.40% | 0.30% | |

| 3:30 PM | HK | Gdp Growth Rate (Tahunan) Adv Q1 | 4.30% | 2.50% | |

| 7:30 PM | US | Neraca Perdagangan MAR | $-68.9B | $-68B | $ -69.0B |

| 7:30 PM | US | Ekspor MAR | $263.0B | $260.0B | |

| 7:30 PM | US | Impor MAR | $331.9B | $329.0B | |

| 7:30 PM | US | Klaim Pengangguran Awal APR/27 | 207K | 208K | 207K |

| 7:30 PM | US | Produktivitas Kerja Non-Pertanian QoQ Perkiraan Awal Q1 | 3.20% | 1.60% | 1.70% |

| 7:30 PM | US | Biaya Unit Tenaga Kerja QoQ Perkiraan Awal Q1 | 0.40% | 2.00% | 1.80% |

| 9:00 PM | US | Pesanan Pabrik MoM MAR | 1.40% | 1.60% | 1.80% |

| Friday, 03 May 2024 | Previous | Consensus | Forecast | ||

| 3:30 PM | GB | Final IMP Layanan Global S&P APR | 53.1 | 54.9 | 54.9 |

| 7:30 PM | US | Upah non Pertanian APR | 303K | 210K | 190.0K |

| 7:30 PM | US | Tingkat Pengangguran APR | 3.80% | 3.80% | 3.80% |

| 7:30 PM | US | Pendapatan Rata-rata Per Jam MoM APR | 0.30% | 0.30% | 0.30% |

| 7:30 PM | US | Pendapatan Rata-rata Per Jam YoY | 4.10% | 4.10% | |

| 7:30 PM | US | Tingkat Partisipasi APR | 62.70% | 62.70% | |

| 8:45 PM | US | Final IMP Komposit Global S&P APR | 52.1 | 50.9 | |

| 8:45 PM | US | Final IMP Layanan Global S&P APR | 51.7 | 50.9 | 50.9 |

| 9:00 PM | US | PMI Layanan ISM APR | 51.4 | 52.3 | 51.8 |

| Saturday, 04 May 2024 | Previous | Consensus | Forecast | ||

| 6:45 AM | US | Pidato Fed Goolsbee | |||

| 6:45 AM | US | Pidato William Fed | |||

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

|---|---|---|---|---|---|---|---|---|

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 97.77 | 96.77 | 6.46% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 99.9 | 98.9 | 6.76% | BBB |

| INKP02CCN1 | IDA0001183C1 | IDR | 10.00% | 30-Sep-26 | 100.5 | 99.5 | 9.76% | idA+ |

| LPPI02ACN1 | IDA0001331A0 | IDR | 10.50% | 4-Jul-26 | 101 | 100 | 9.98% | idA |

| SMINKP03CCN2 | IDJ0000276C5 | IDR | 11% | 25-Aug-28 | 101.75 | 100.75 | 10.24% | idA+ |

Provided by Cermati Invest, last update 26 April 2024

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT)

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 22 April 2024

- Cermati Invest Weekly Update 16 April 2024

- Cermati Invest Weekly Update 1 April 2024

- Cermati Invest Weekly Update 25 Maret 2024